Coast, which offers a simple and smart way for companies in the United States to manage fuel and fleet spending, today announced it has raised $92 million in new funding. The round includes $25 million in equity capital led by existing investors, including BoxGroup, Avid Ventures, Accel, Insight Partners, and Better Tomorrow Ventures, as well as new investor Vesey Ventures. The company also secured $67 million in committed debt capital from Silicon Valley Bank and TriplePoint Capital.

For the nearly one million American businesses that collectively operate around 40 million vehicles in their commercial fleets – including field service businesses like HVAC, plumbing, landscaping, and pest control, construction, government fleets, and long-haul trucking – managing expenses in the field is a major challenge. Over the decades, a handful of now very large incumbent payment solutions have emerged to serve fleet-operating companies’ needs with fuel cards, to allow fleet managers to set field-specific controls, like restricting purchases to only fuel products, or tracking expenses on a per-vehicle basis. The fleet fuel payments on these specialized cards add up to a staggering $120 billion annually in the US.

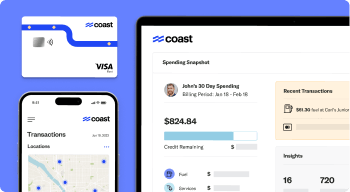

Coast, led by founder and CEO Daniel Simon, reimagines the fleet payments product category, enabled by mobile technology and state-of-the-art vehicle data and telematics. Coast’s software gives fleet managers powerful policies and controls that they can tailor to the on-the-job needs of different employees and vehicles in their fleets. It uses real-time information that employee drivers provide through their phones, as well as data from the onboard computers of company vehicles, to authorize or flag transactions. For example, the fleet manager of a commercial construction HVAC company could receive an alert if a driver purchased unleaded gas when driving a company diesel vehicle, indicating potential abuse; automatically block a transaction when the attempted purchase is far from the current GPS location of the vehicle; or pre-approve a one-time extra purchase of on-the-road supplies at Home Depot with a simple, automated SMS workflow.

Adam Rothenberg, partner at BoxGroup, said about the round “we’ve been amazed by the pace of execution of Coast’s business since we first invested in the company at its founding, as well as by the scope and consistency of Daniel’s vision for financial tools for fleet operating industries. In the current market, it’s more important than ever to back companies that have shown they can achieve really great unit economics by serving a well-understood need. We were thrilled to find an opportunity to deepen our investment in Coast and continue our partnership with Daniel.”

The market has greeted Coast’s offering with enthusiasm. The company has grown its business more than fivefold in 2023, and it now serves thousands of businesses., some with just a handful of fleet cards and others with over 1,000. Surveyed customers saved an average of 9-10% on their fuel bill and 16 hours of monthly administrative work when switching to Coast from another fuel card or another payment method. Coast software controls have been so effective in reducing abuse and waste that the company recently rolled out a first-of-its-kind security guarantee, promising to cover any losses for fuel theft up to $25,000 annually for customers that enable Coast’s unique security settings.

To add to their momentum, Coast has inked partnerships with fuel brands such as 7-Eleven Fleet (including Speedway), Casey’s, RaceTrac, and EG America brands (including Cumberland Farms), as well as retailers like Discount Tire to offer larger discounts to Coast customers while driving loyalty and repeat business for these brands.

Coast also announced that it had entered into a relationship with Visa, a world leader in digital payments, to accelerate its fleet offering. Veronica Fernandez, SVP, North America Head of Visa Commercial Solutions, said, “Coast has been an innovative leader in fleet payments, and Visa is excited to collaborate further with them to create a new generation of offerings enabled by Coast’s powerful expense management software. With Coast’s platform and Visa’s advancement in fleet, together we can provide more security, control, visibility, and reporting to all kinds of fleet operators, for all of their vehicles, both gas and electric.” Coast cards are issued by Celtic Bank, pursuant to a license from Visa U.S.A. Inc.

With the new funding, the Coast team will focus on product development, adding new integration partners as well as supporting businesses expenses beyond fuel. The raise will also accelerate Coast’s go-to-market capability, including the establishment of a second site in Salt Lake City.

“Coast is the financial platform for the future of transportation and the trades,” said Simon. “We are building a holistic expense management and finance platform for fleet-operating businesses. We’re now well-positioned to expand our product and get it in the hands of more fleet operators and drivers.”

Addie Lerner, Founder & Managing Partner at Avid Ventures, added, “Since initially partnering with Daniel and Coast over three years ago, our conviction in the team’s vision and execution capabilities has only deepened. This recent investment makes Coast one of the largest positions in Avid’s first fund, reflecting our excitement in Coast’s trajectory towards reshaping the industry. The team and market opportunity, combined with the company’s best-in-class unit economics, rapidly evolving product suite, and growing traction with larger fleets reinforce our confidence.”

Brian Foley, the head of warehouse lending and relationship management for SVB’s national fintech practice, said “Coast provides a strong financial product backed by powerful software for fleet-operating businesses, which allows it to attract very high-quality companies as customers. SVB is excited to continue to support Coast’s growth and provide the debt capital to help them serve these businesses for the long term.”

About Coast

Coast is re-imagining the trillion-dollar US B2B card payments infrastructure, with a focus on the country’s 500,000 commercial fleets, 40 million commercial vehicles, and many million commercial drivers. Drivers, fleets, and the merchants that serve them all increasingly demand modern digital payments experiences and affordable and transparent financial services products. Coast’s mission is to deliver them at a transformational scale and to improve working lives in one of the country’s biggest industry sectors. Coast is founded and led by Daniel Simon, who previously co-founded digital payments platform Bread (breadpayments.com), which was acquired by Alliance Data Systems for more than $500 million in 2020. For more information, visit coastpay.com.

About BoxGroup

BoxGroup is an early-stage venture capital firm based in NYC and SF. BoxGroup backs entrepreneurs building disruptive technology companies and with visions to create the next generation of category defining businesses. BoxGroup’s portfolio across seven funds includes early investments in Plaid, Ramp, Stripe, Flatiron Health, Airtable, Amplitude, Ro, Scopely, and more. https://www.boxgroup.com/

About Visa

Visa Inc. (NYSE: V) is a world leader in digital payments. The company’s relentless focus on innovation is a catalyst for the rapid growth of digital commerce on any device for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce.

For more information, visit About Visa, visa.com/blog and @VisaNews.

About Avid Ventures

Avid Ventures is a $165M early-stage venture capital firm based in New York City backing exceptional founders building transformative fintech and software companies across North America, Europe, and Israel. Avid actively partners with founders and their teams from the Seed stage through Series B as a “Strategic Finance Advisor” to grow startups into proven growth businesses with best-in-class metrics. Since its founding in 2020, Avid has invested in 25+ companies including Rapyd, Alloy, Coast, Clara, Oyster, Balance, Nova Credit, and Thatch.

About Silicon Valley Bank

Silicon Valley Bank (SVB), a division of First Citizens Bank, is the bank of some of the world’s most innovative companies and investors. SVB provides commercial and private banking to individuals and companies in the technology, life science and healthcare, private equity, venture capital and premium wine industries. SVB operates in centers of innovation throughout the United States, serving the unique needs of its dynamic clients with deep sector expertise, insights and connections. SVB’s parent company, First Citizens BancShares, Inc. (NASDAQ: FCNCA ), is a top 20 U.S. financial institution with more than $200 billion in assets. First Citizens Bank, Member FDIC. Learn more at svb.com.

Media Contact:

Heather Ripley

Ripley PR

865-977-1973

hripley@ripleypr.com