- NO per-gallon administration fee

- NO electronic payments fee

- NO reporting fee

- NO portal access fee

- NO inactive card fee

- NO phone payment fee

- NO per-transaction fees in the US

Smart Fleet Fuel Cards

Smart Visa fuel cards for every fleet expense

The most flexible fleet card ever

Accepted anywhere

Save 2-10¢ per gallon* everywhere Visa is accepted. Unlock additional spend categories for on-the-job expenses.

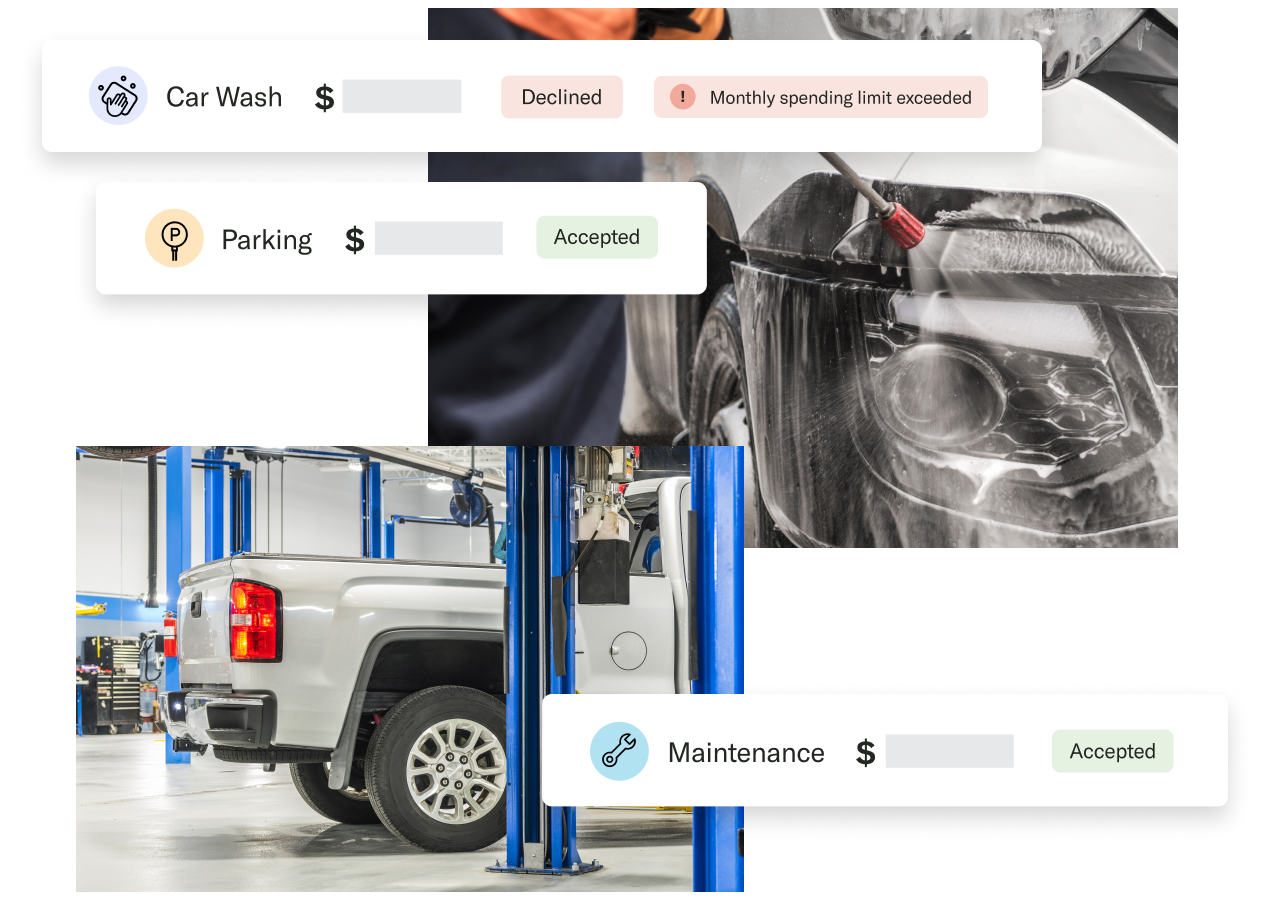

Customizable controls

Set spend limits, get real-time alerts, and only enable categories your employees need.

Assign new cards in seconds

Keep extra inactive cards on hand for free and never wait for cards when you need them.

With Coast, you set the rules

No matter how many vehicles you have, you need to be in control of what your fleet spends. With Coast, you can set limits, issue cards, and authorize payments in a few clicks.

Set limits and rules

Order and assign cards

Authorize payments

Stop abuse and fraud - fast

We’ll alert you of risky transactions so you can set rules and stop fraud before it can impact your business.

Fuel up at any gas station that accepts Visa®

Coast can be used for fuel and fleet expenses at any gas station or truck stop where Visa is accepted, meaning your drivers can fill up at the least expensive, most convenient station.

1% back when you centralize your fleet expenses on one card

Optimize your parking, maintenance or restaurant spending with precise controls per merchant category. Earn 1% cashback on every purchase at merchants other than gas stations, with no cap or tier.

Issue and manage cards with a click

Coast cards are interchangeable. Keep a stack of backup cards and easily assign and reassign as needed. Only pay for active users.

Try Coast out for yourself

Fees we

DON’T charge

Get exclusive discounts from our large partner network

Testimonials