Managing expenses can be a challenge for any field service company. Construction companies, however, are particularly susceptible to inefficiencies and waste.

Because every construction project is different, it can be difficult to standardize purchasing rules. The use of subcontractors can also be problematic as it gives construction companies less direct control over how purchases are made. These factors can lead to a lack of oversight and control, which increases the risk of inefficient—or even fraudulent—spending. This, in turn, can drive up costs and eat into profits.

To learn more about field expense management practices, we surveyed 200 construction company employees with responsibility for managing or reviewing field spending. We found that many companies are wasting both money and time despite meaningful attempts to control expenses.

Note that total percentages may exceed 100% as respondents were allowed to select multiple answers for some questions.

How Are Construction Employees Making Purchases?

Across the board, construction employees are making work-related purchases: respondents said that either “all” (42%) or “some” (58%) of the employees in their company make job-related purchases.

The purchases themselves cover a range of items, including transportation (44%), vehicle maintenance (52%), and accommodation (32%), with supplies/materials (86%) and fleet expenses such as fuel, parking, tolls, and car washes (62%) being the two most popular answers.

Work-related purchases are a common occurrence: 69% said their employees make weekly purchases, and another 20% said they make purchases on a monthly basis. Many use more than one purchasing method: 55% use corporate cards, 46% use fuel cards, 33% rely on house accounts, and 22% on vendor-specific cards. 43% get reimbursed after using their personal cash or card.

How Easy Is It for Construction Companies to Approve, Track, and Reconcile Purchases?

Interestingly, 61% of respondents are using manual processes (e.g., phone calls) to review spending in real time. Only 25% use a software-enabled process, and a full 13% don’t have a process at all.

Companies use multiple methods for tracking the expenses themselves. These include expense management software (33%), accounting software (48%), spreadsheets (36%), custom expense reports (29%), and email (33%).

How Well Do Employees Follow the Rules?

Construction companies are clearly making an effort to inform employees of their purchasing policies: 57% regularly share their policies in written form with their staff, communicate policies verbally (59%), and/or inform employees of them during onboarding (49%). Only a very small percentage, 1.44%, fail to communicate policies at all.

Companies also use a number of measures to prevent or reduce unauthorized spending. Almost 70% collect receipts, 39% rely on an expense approval workflow, 46% have pre-approval requirements, 39% have card spending limits, and 36% have expense policies in place.

However, whether through deliberate disregard or simple misunderstanding, it’s clear that not everyone follows the rules. Well over half (57%) of respondents encounter instances of unauthorized or wasteful spending among field employees at least once per quarter. More specifically, 40% have suspected, witnessed, or experienced instances of misuse or abuse specifically related to company spending cards.

How Does Wasteful Spending Affect Construction Companies?

The impact of wasteful spending adds up. Over 36% estimate that wasteful spending costs their company $100–$1,000 a quarter, while almost 6% think it costs over $5,000 a quarter. Given that over half (53%) of respondents work for companies with less than $5 million in revenue, this kind of loss could have a significant impact on the bottom line.

While almost all companies have spending policies in place and are making an effort to keep employees informed about them, it seems that many employees simply aren’t following them. 17% of respondents said current processes were not effective or only slightly effective; 31% estimate that better compliance with policies would save between 10-20%.

What Is the Impact to Businesses?

Time and money are on the line.

Tracking multiple expenses across different purchase methods can be time-consuming and confusing. It is probably not surprising, then, that 48% feel they’re spending too much time reconciling expenses with company budgets. As mentioned above, 61% are using manual processes to review spending, further compounding the issue.

No doubt this complexity contributes to both mistakes and abuse — 44% report that either they or someone in their company have uncovered instances of wasteful spending or policy abuse in the past year.

Methodology

We surveyed 200 construction industry employees who have responsibility for managing and/or reviewing field spending in some capacity. The survey was conducted over a two-week period in March 2024 and was limited to U.S.-based respondents.

Closing Thoughts

Enabling employees to make work-related purchases is essential to efficient operations. This is especially true for construction businesses where purchases often need to be made quickly in response to immediate needs. Of course, it’s also essential to control spending and ensure that expenses are easy to track.

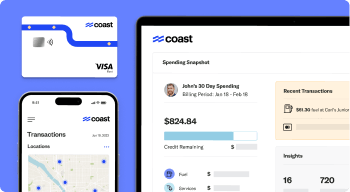

Coast’s all-in-one fuel card solution simplifies employee expense management, giving construction companies unparalleled visibility into expenses. Businesses can use our set-it-and-forget-it technology to create robust, customizable spending policies that are automatically enforced. Easier compliance means you can save time and money and enjoy the peace of mind that comes from knowing the rules are being followed.