My career journey led me to join Coast, a fintech startup fueling fleet-driven businesses of every size. I’m sharing more about my experiences along the way with the hope it may help you consider your own options (even if ultimately you decide the startup life isn’t for you).

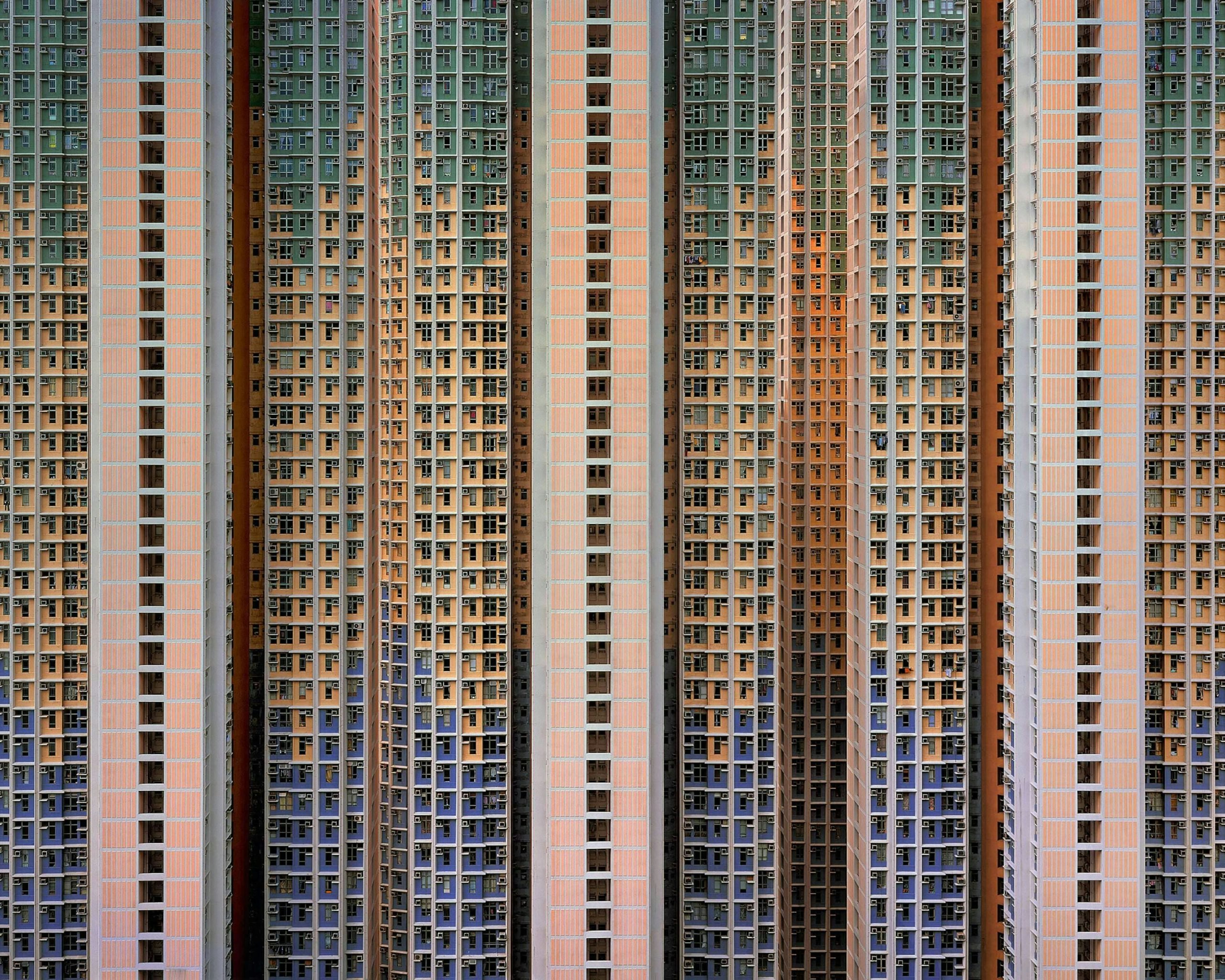

Islands

For most of my career, I worked in large companies with engineering departments in thousands or tens of thousands. At the same time, I always ended up in small cross-functional orgs tasked with building something disruptive to the existing business—from the first foray into retail e-commerce in the 90s, to jumpstarting new financial products as a part of a consultancy.

All of these were the ring-fenced islands building new products, and time to market and short cycle times were crucial.

Faster dinosaurs

Only in my most recent role as Chief Architect for Capital One Commercial Bank did I get to work on the other side of the spectrum: the org I led was accountable for major technical decisions in the bank’s ~200 applications portfolio supported by 130+ teams.

This recent role gave me a perspective on maintaining large existing product portfolios. While the scope is rewarding in its own way, I realized that I got the most joy out of the tangible sense of progress and creation that comes from building a new product, unencumbered by decades of legacy.

A whole different kind of animal

It also happens that for the last few years I was noticing a new crop of vertically integrated startups that ran circles around big established banks: those startups that focused on the experience of a specific type of client and went all in. They not only built payments and banking for them, but a whole suite of integrated services used by their clients daily. And if valuations, customer growth, and liquidity events are any indication, these startups took off like wildfire.

Larger organizations I worked for at the time were not oblivious to this trend. In fact, strategy and sales teams understood the value of these verticals very well, but everything ground to a halt when it came to product engineering.

Inertia and sprawl

As it turns out, building bespoke, vertically-integrated experiences that embed into the clients’ business deeply is very hard in the world of existing fragmented products — which is what most of the big banks have. Even moving to the cloud is a small help at the end of the day: it addresses some infrastructure complexity way down the stack at best.

In order to build multiple bespoke experiences, there needs to be the middle “platform” layer of domain services, systems of record, common capabilities—factored out to build on for multiple specific verticals. It is a hard engineering and organizational problem, usually years or even decades in the making — if even considered feasible at all. Furthermore, this factoring out requires a determination, focus, and directed movement on top of these fragmented products that in turn are evolving and continuing to drift apart as each individual business is pursuing its own agenda.

And of course, in order to build an experience that ties all these systems together, they need to match the org structure, otherwise the Conway Law will always prevail.

Joy, impact, and risk

Contrast this with the single-minded focus on the client and the product of a typical startup. All your resources are spent on building features for the clients. You move orders of magnitude faster, taking weeks to deliver with a single team what it takes years and small armies in larger companies.

Over the years I realized that this hyper-focused, customer-obsessed, feature-driven mode of operation brings me the most joy. The tight feedback cycle of clients using something a week after it showed up as a story on the board for the first time.

As the time in my most recent big company went by, I got increasingly restless, watching the opportunities to build financial services for this or that vertical come and go. I would talk to this and that startup (some later became “unicorns”) and then get cold feet—pandemic, golden handcuffs, something. This is when Daniel Simon from Coast came knocking, again and again, as he was bootstrapping Coast.

I was really impressed with the early team of core employees he pulled together. His vision for Coast—an early stage startup building a vertically integrated suite of financial services for the commercial vehicle industry—matched my interests, and the Head of Engineering role played to my strengths.

I talked to many other large companies just before jumping to Coast, from Big Tech to Big Retail. As an immigrant in the US, I had a tendency to play it safe and stick to big companies that weathered the storms very well — safe, but also boring and slow. I knew I could always come up with more reasons to not make the startup leap — but I also kept reminding myself that if I am not scared, I am not pushing myself enough.

The major factors that de-risked the decisions for me at the time:

- A founder who has done it before, and knows how to build a company that makes money

- A clear path path to profitability, instead of a piece of new tech looking for ways to monetize itself

- A business vertical that is clearly underserved, where newcomers can win with software

And finally, based on parallel interviews with Big Tech and Retail, I figured I could always get hired there if push came to shove.

Coast

So what is Coast?

Having lived through many tech hype cycles, I did not want to put X on the Blockchain with a DEX on the side; I was not going to spend my time wrangling NFTs, and then packaging it all up into Metaverse and launching it all into the low Earth orbit. Instead, we focus on underserved clients that should get better services, we have a solid business model, and clear unit economics. This is tangible, personal, and real. For someone that spent a decade working on increasingly esoteric financial instruments in capital markets, this was a welcome change.

We know how to build a nimble, fast-growing, real software-based business. This is what we compete in, and this is the differentiator we bring to this market vertical.

Building products is in our DNA—the core engineering team worked together on and off for over a decade, and most of us have two decades of experience each. We have experienced failure and learned from it, we got inoculated against most of the things that derail software projects—the hunt for the mythical silver bullet (this new tech X or process Y will solve everything!), over-investing or under-investing in quality, gold-plating and losing focus, prematurely investing in infrastructure, failing to show client value and iterate on it, and the list goes on.

Joining an early-stage company is not for everyone. For me personally, it is the amount of joy and excitement and tangible impact that I get from working in a small, super-sharp, well-gelled cross-functional team.

And I have to admit that some of it is also the lifestyle—the NYC fintech startup life—scrappy, smart, pragmatic, fast-paced and driven. We have an office in NoHo, we work together in person to maximize high-bandwidth communication and get closer to sales and customer service that work with clients directly. I feel that we also manage to sidestep the trappings of startup life as portrayed on TV shows like “Silicon Valley” (big fan!), while taking advantage of all the good things that make startups so special to work for.

Anton Maximov is Head of Engineering at Coast.