If you operate a fleet, you know how important it is to account for fluctuating fuel prices. One way to do that is with a fuel surcharge — a standard practice that protects businesses who rely on fleets from sudden fuel price spikes.

In this article, we’ll explain how fuel surcharges benefit businesses with fleets of all sizes, how to calculate them, and strategies for saving on fuel and achieving healthier margins for your fleet operations.

Table Of Contents

- What Is A Fuel Surcharge?

- Creating A Fuel Surcharge Policy

- Determining Fuel Surcharges

- Tips For Making The Most Of Your Fuel Surcharge

What Is A Fuel Surcharge?

A fuel surcharge is a fee that companies charge customers above the current price of fuel to account for potential fuel price changes between when a delivery or service was scheduled and when it actually happened.

For example, fuel may cost $3.00 per gallon when a corporate client books a fleet of charter buses through a transportation business. But since the price of fuel constantly fluctuates, that cost can increase to $4.00 per gallon by the time the drivers arrive to pick up the passengers.

As you can imagine, if the company’s drivers are traveling hundreds of miles for this specific job, that extra $1 per gallon can really add up and impact profit and cash flow.

This is where fuel surcharges come in. They allow fleet owners and managers to offset some of their fuel expenses and improve the stability of their earnings.

Why Are Fuel Surcharges Necessary?

Given the historical and recent volatility of fuel prices, fuel surcharges have become a standard practice across a variety of industries in order to protect against and account for unexpected fuel and gas price increases.

For some businesses, fuel prices aren’t an issue, but for those in the transportation industry and field services industries — such as HVAC, plumbing, construction, pest control, roofing, and landscaping — fluctuating fuel prices can have a significant impact on cash flow and profitability.

By incorporating a fuel surcharge policy, fleet managers, operations managers, and financial controllers alike can minimize the risk that comes with volatile fuel prices. Let’s look at a couple of specific examples to see how fuel surcharges can benefit businesses in the transportation and field services industries.

The Importance Of Fuel Surcharges For Larger Small-Sized Businesses

For operations managers or COOs of mid-sized businesses, accurately quoting prices for each job is critical. Precise quotes not only reflect your business’s professionalism but also safeguard its financial health.

For example, a construction company might have a year-long roofing project at a new apartment complex. In their quote, they include fuel costs. However, if fuel prices spike unexpectedly midway through the project and they haven’t factored in a fuel surcharge, the company’s cash flow could suffer, potentially straining resources and delaying project timelines.

This is where the strategic incorporation of fuel surcharges becomes crucial. Fuel surcharges are not just a financial tool for construction companies; they are vital for project planning and maintaining client relationships.

By effectively managing fuel surcharges, the above construction business can navigate the uncertainties of fluctuating fuel prices, ensuring profitability, operational efficiency, and client satisfaction.

This proactive approach not only boosts the company’s resilience in the face of market fluctuations but also builds trust with clients who appreciate transparent and adaptive pricing strategies.

The Importance Of Fuel Surcharges For Medium-Sized Businesses

For financial controllers or operations managers of businesses with larger sized fleets, such as 30 or more, managing costs and making accurate forecasts is essential. Skillful financial management here directly translates to sustained operational success and competitive edge.

Many transportation businesses have long-term contracts with corporate clients. Given the frequent long distances these fleets cover, fuel becomes a major variable expense.

With fluctuating fuel prices, fixed pricing can make it challenging to forecast costs, profitability, and overall cash flow for each contract. This unpredictability can lead to strained budgets and affect the company’s ability to invest in fleet upgrades or future expansion.

Incorporating fuel surcharges allows for better financial visibility and enables transportation businesses to offer competitive prices, factoring in potential changes in cost structure.

This strategy not only safeguards the company’s margins but also demonstrates to clients their commitment to fair and dynamic pricing, enhancing the business’s reputation in a market where trust and reliability are paramount.

Creating A Fuel Surcharge Policy

Perhaps surprisingly, there are no laws or regulations in the U.S. that mandate how fuel surcharges should be handled. There is currently no official oversight from any federal agency.

This means that carriers have different policies for calculating fuel surcharges. You have the freedom to choose a method that makes the most sense for your company.

It’s important to note, however, that just because there isn’t a federal watchdog enforcing rules, it doesn’t mean there aren’t best practices to abide by.

The three primary goals of your fuel surcharge policy should be:

- Protecting your business’s operating margins from the effects of fuel price volatility

- Keeping your prices competitive

- Providing transparency to your operations managers, fleet managers, accountants, financial controllers, and customers

Let’s discuss how to calculate fuel surcharges, step by step.

Determining Fuel Surcharges

To calculate fuel surcharges accurately, you need four pieces of information: the base fuel rate, the mileage your fleet vehicles get, the total distance of the trip, and the actual fuel price when the trip takes place.

Calculating Fuel Surcharges Step By Step

1) Determine The Base Fuel Rate

The base fuel rate is the cost of fuel at the time you provide a price quote to your customer. There are two different methods for determining this rate.

The first is to use actual fuel prices from the Energy Information Administration. The EIA lists current fuel prices broken down by region, state, and city, updated every Monday. The second method is to simply use a fixed base fuel price, such as $3.50.

For the purposes of a sample calculation, consider a medium-sized limo business based in Florida, where the current fuel rate in the region is $4.00 per gallon.

2) Note Vehicle Fuel Mileage

This is simply how far the vehicles in a fleet can travel on a single gallon of fuel. If the person completing the fuel surcharge calculation is the COO or fleet operations manager for the business, they probably already know this figure.

If not, they can use the EPA mileage rating for the vehicles, understanding that the EPA mileage figures quoted by vehicle manufacturers are under ideal conditions, and they often won’t get that level of fuel efficiency.

Fleet managers can get a more accurate estimate of fleet vehicle fuel mileage by tracking the miles driven on each tank in real-world conditions.

For the limo business example with simple figures, each corporate limo gets 10 miles per gallon.

3) Figure Out The Traveling Distance

Modern navigation tools allow COOs and fleet managers to determine exactly how many miles their vehicles have to travel for each delivery or service. They can simply plug the starting address and ending address into a GPS to see the traveling distance.

Sticking to the limo business example, the distance traveled is 100 miles from the client’s office to their destination.

4) Determine The Actual Fuel Price

The difference between the cost of fuel when an initial quote was provided and the cost of fuel when the service was delivered is why fuel surcharges exist.

To find the actual fuel price, return to the EIA data and see what the fuel prices were for the week of the delivery. In our example, fuel costs in Florida rose from $4.00 per gallon (the base price) to $4.50.

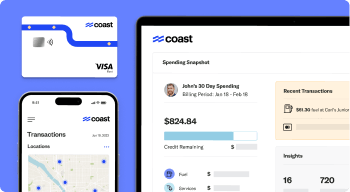

Pro tip: To get a clear picture of your actual data in detail, try incorporating a fleet management platform, like Coast, into your workflow.

5) Crunch The Numbers

With all of the above information, it’s time to actually calculate the fuel surcharge. This will be pretty straightforward for financial controllers or accountants, assuming they have an easy way of accessing the data.

However, not all companies apply a fuel surcharge in every situation. Some only do so if the increase is above a certain threshold — for example, 10% higher than the base price.

In the limo business example so far, the spike to $4.50 is an increase of more than 10%, so we’ll proceed with our surcharge calculation.

One commonly used formula to calculate the fuel surcharge is:

(Actual fuel cost – base fuel cost) / vehicle fuel consumption per gallon x number of miles traveled

Now let’s plug in the numbers from our example.

Subtracting the base fuel cost ($4.00) from the actual fuel cost ($4.50) gives us $0.50. Dividing $0.50 by the miles per gallon the vehicle can travel results in a fuel surcharge fee of $0.05 per mile.

Multiplying this by the distance traveled (100 miles) gives us a total fuel surcharge of

$5.00.

While that may not seem like a large amount, it can add up quickly given the number of vehicles in a fleet, how frequently they’re used, and how far they travel.

Percentage-Based Fuel Surcharges

For long-haul trips where vehicles will travel across multiple regions — and therefore refuel in several regions as well — calculating the fuel surcharge can get complicated.

Take our medium-sized limo business example. In that business, the drivers likely make deliveries between towns, states, or even across the country. That can make determining the fuel surcharge difficult because there will be varying per-gallon fuel costs for the same trip.

The fleet manager could average out the fuel cost from each region the trip covers. However, to save time, some managers opt to use a percentage-based fuel surcharge fee in such cases. Of course, this method is not as accurate as basing the surcharge on real fuel costs.

Tips For Making The Most Of Your Fuel Surcharge

Fuel surcharges are a way of protecting your business from fuel price fluctuations that you can’t control. But there are things you do have control over to make your fuel surcharge calculations more accurate and help you save on fuel in spite of volatile pricing.

Save With Fuel Cards

One of the best ways to achieve healthier operating margins for your company fleet is by using a fuel card.

Look for a fleet fuel card that is widely accepted and gives you rebates on every gallon of fuel you buy. Ideally, your card should also allow drivers to pay for other fleet-related expenses as well and let managers set up detailed spending controls to stop waste or fraud.

Track Your Fuel Spending

If you want to take control of your company’s fuel expenses, you need to know exactly how much you’re spending. That means being able to see the details of every fuel purchase, without having to collect receipts or reconcile multiple statements.

To help with this, choose a fuel card company that offers a platform with detailed reporting and all of the information you need to track your fuel spending.

Use Telematics

Telematics is the practice of using technology to gather real-time data about the activity of the vehicles in your company fleet.

Telematics helps you cut your fuel costs by giving you greater insights into your fleet operations. You can identify potential fuel-wasters, like non-optimal routes, increased idling, and excessive acceleration.

Armed with this information, you can improve your driver training to make your fleet operations more efficient.

More Insight And Less Spending With Coast

Fuel surcharges can help your fleet stay in the black, regardless of sudden fuel price increases. Calculating these surcharges is simple once you decide on the method that makes the most sense for your business.

To determine fuel surcharges more precisely and help your business save on fuel, consider the Coast fleet and fuel card. Coast’s wide acceptance, rebates on every gallon of fuel purchased, and robust purchase tracking will help keep your fleet’s operating margins healthy.

To learn more, visit CoastPay.com today.