Two years ago, we surveyed our customers to understand the value Coast brings to construction, trades, and transportation businesses. The results were encouraging, but we knew we could do better. So we kept listening to our customers, and built the features they needed to make their fuel management and finance processes smoother.

We’ve expanded our partner network to over 30,000 stations, deepened our integrations with tools like QuickBooks and Samsara, and refined our fraud detection.

Two years later, we went back to our customers with a simple question: What’s Coast actually worth to your business? We surveyed 132 Coast customers, from 10-vehicle fleets to operations running 600 vehicles, across construction, transportation, and trades.

We learned that, on average, Coast customers save $30,000 per year and save 19 hours of busywork and admin processes every month. Instead of achieving this through deeper rebates or cutting corners, they eliminated time and money waste.

$30,000 in Annual Savings: Fuel Fraud, Smarter Purchasing, and Expense Control

Stopping fraud before it happens

Before switching to Coast, our customers estimated that 5% of their employees had made unauthorized purchases, and 3% of total transactions involved misuse or fraud.

The pattern we hear from customers is consistent: expenses feel manageable when you’re small, but as the team scales, the problem compounds. What worked with 10 employees breaks down at 50. By the time you notice, thousands of dollars are already gone.

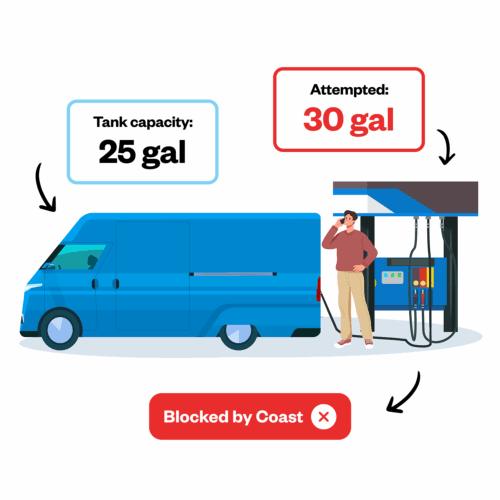

Coast stops this before it starts. The system blocks 5% of attempted purchases at the pump on average, using controls like GPS verification and fuel tank capacity checks. When someone tries to pump 30 gallons into a truck with a 25-gallon tank, the system catches it. When a card is swiped 50 miles from where the vehicle is actually located, the transaction gets flagged or declined.

Choosing the most cost-effective stations

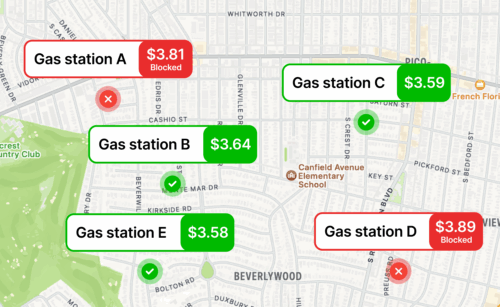

Fuel prices can vary by 30 cents per gallon within the same zip code. Over time, using those “convenient” gas stations can add up.

With Coast, fleet managers can proactively block expensive merchants before employees even swipe their cards. One customer noted: “Much easier to watch spending & block expensive gas stations.”

Combine that with our expanded partner network, where customers now save up to 9 cents per gallon at 30,000+ stations, and the savings compound quickly.

Corporate spend: the other half of the equation

Fuel isn’t the only place money leaks. Employee expenses, such as tools, materials, and vehicle maintenance can also be wasteful.

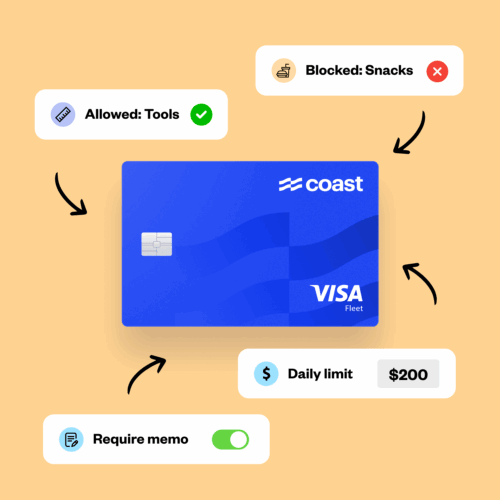

Customers told us they lacked granular control when they used their existing corporate card for these types of expenses. Cards either had no limits (and were therefore very risky) or employees had to go through cumbersome approval processes before they were able to make a purchase. Receipts went missing and transactions couldn’t be tied to specific jobs, costing them untold hours in admin time and busywork.

Coast lets you control expenses by employee, department, location, or seniority, and actually enforce those rules.

19 Hours Saved: Real-Time Visibility, Automated Receipt Capture, and Seamless Accounting Integrations

Money matters, but so does time. Our survey revealed something striking: companies reduced time spent managing fuel purchases by 56% after switching to Coast, and manage their expenses 2x faster.

Where did those hours go?

Card management? Consider it handled.

Managing cards is often a full-time job: ordering cards for new employees, dealing with lost ones, updating spending limits, waiting on replacements. It’s reactive, time-consuming, and keeps you from focusing on what actually matters.

With Coast, card management becomes a background task. Cards are assigned dynamically, so you never have to wait for a replacement card. You can just reassign an existing one to a different employee or vehicle. You can onboard and offboard employees in real time, directly from your portal, without calling support.

Admins monitor spending in real time and only focus on alerts, whether ****it’s ****suspicious transactions, unusual spending patterns, or policy violations. No more month-end surprises when it’s too late to do anything about them.

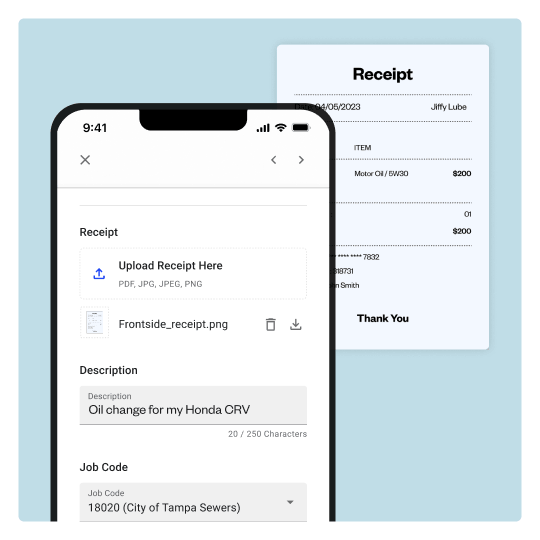

Chasing receipts (and the people who lost them)

Before Coast, closing your books every month looked the same everywhere: emails to field crews, and a mounting pile of crumpled receipts that may or may not match the transactions in your accounting system.

With Coast’s mobile app or texting process, employees snap a photo of their receipt in 10 seconds at the moment they spend. The system automatically matches it to the transaction. No chasing. No gaps in your records.

Accounting automations that eliminate manual work

Reconciling credit card spend typically keeps the finance team tied up for a week every month. Coast helps speed up the process by reducing manual entry and replacing it with automation. Instead of coding card transactions one by one, users can set up smart rules to automatically tag your transactions with the right GL code or vendor. Once coded, your transactions are automatically pushed to QuickBooks, Sage Intacct, or Netsuite, to avoid entering every single purchase into your system.

Why This Matters

We didn’t build Coast to be another fuel card. We built it because we kept hearing the same frustrations from construction and trades businesses: fraud you couldn’t stop, time wasted on administrative busywork, and zero visibility into where money was actually going.

The $30,000 in savings and 19 hours reclaimed every month are the result of listening to customers, building the expense management and card features that actually solve their problems, and continuously improving based on their honest feedback.

That’s what drives us, building tools that don’t just work, but work for you.

Ready to find your hidden savings? Learn how Coast can help your business.