In the world of business spending, managing expenses efficiently while maintaining control and visibility can often feel like navigating a labyrinth, with piles of receipts (when you manage to collect them!), unforeseen costs or reconciliation challenges.

At Coast, we’ve been focused since day one on solving these challenges for fuel and fleet expenses. But we know that trades and transportation businesses are facing similar issues with their employee and business expenses, too.

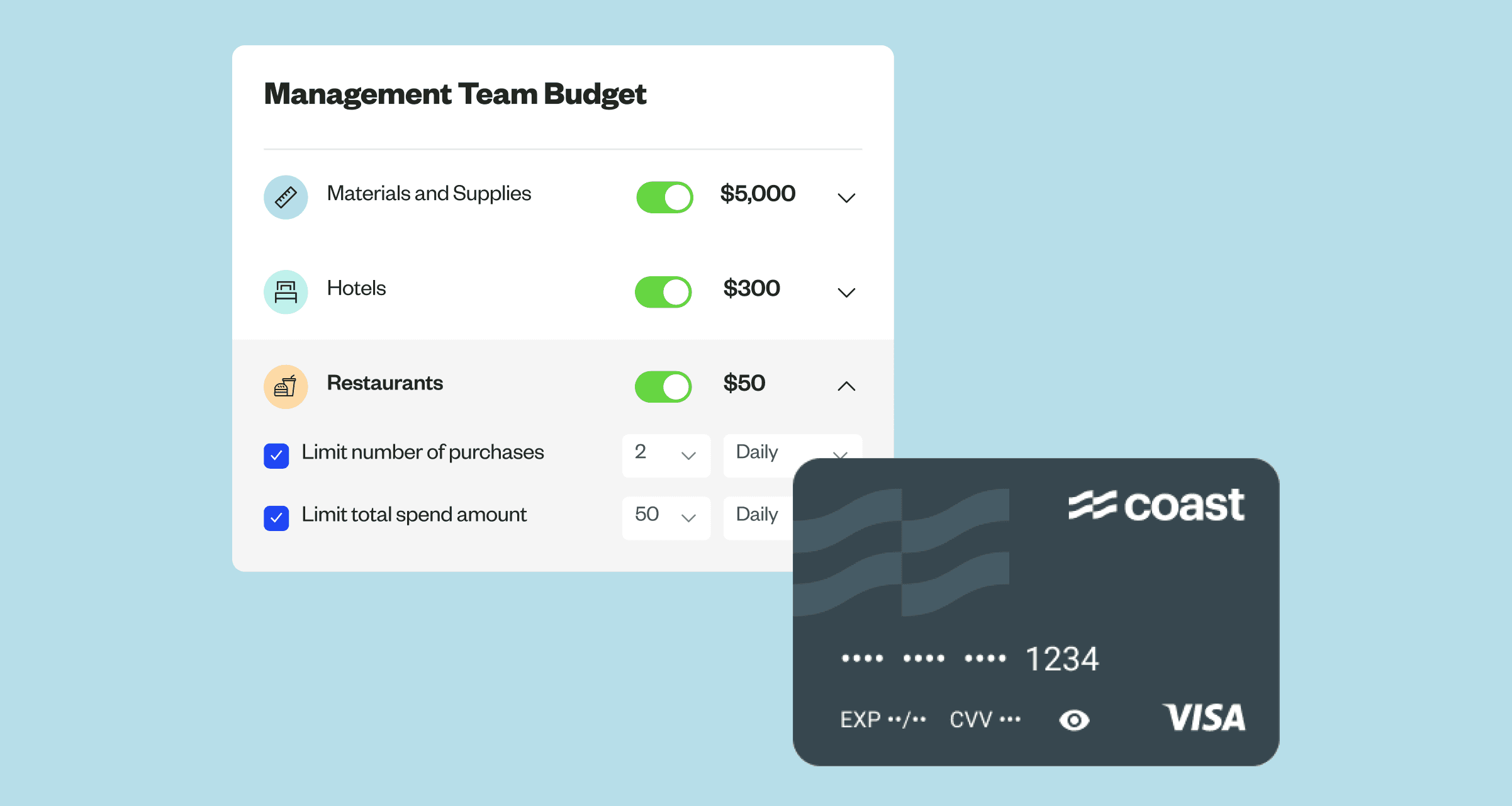

That’s why we’re thrilled to introduce our latest feature: Budgets. With Budgets, we aim to streamline the expense management process by empowering you to plan your spend, by setting clear rules and delegate responsibilities, all while enhancing control and visibility.

Why is controlling and tracking business expenses so difficult?

Today, you might be using your corporate card for your employee or business expense, such as lunch stipends, trips to the hardware store or software purchasing. You might have a single card for your entire business, or give cards to your most trusted managers. You also probably apply spending rules, whether you share them orally or have a more formal approval and review process in place.

These methods provide a sense of security and control but they often fall short in preventing misuse. According to a recent survey, 62% of cardholders were aware that company credit cards were misused for non-business activities within their organization, and 18% say this is commonplace where they work.

Moreover, traditional corporate cards make tracking expenses a cumbersome task. Determining which expenses are tied to specific projects or monitoring budget utilization becomes time-consuming. As a result, businesses either endure a laborious manual process or risk overlooking unverified expenses.

Introducing Budgets

With Budgets, Coast makes business expenses easier. Budgets, combined with virtual cards, let you delegate spend to your employees, all with improved controls and visibility. Your employees are empowered to spend, within the limits that you’ve defined.

In practice, budgets are pre-set policies that can be used for group budgets, travel expenses, or stipends. They let you precisely control who, how, and how much your team can spend. They can apply to multiple users and be used on multiple cards, giving you visibility and control with no sacrifice on convenience.

☝ Note that Budgets and virtual cards cannot be used for fuel purchases yet.

How do Coast budgets work?

It just takes 2 steps to set up and start using your budgets:

- Create your budget Start by creating your budget and determine the spend policies attached to this budget. Spending rules can be applied to the entire budget, or customized per merchant category. You can also require memos and receipts to make tracking and expense review easier.

- Activate your virtual cards Once the budget is defined, budget members just have to create their own virtual cards to spend on this budget. Each employee is responsible for creating their own budget card, which can be used for any purchase online or in-store.

Need inspiration? Get started with these two budget templates

Let’s create two budgets, one for a project, one for an employee travel policy.

Creating a budget for a project

As a trades business, you might be working on several jobs at the same time. You want to allow your technicians and supervisors to spend on the job and want to tie your expenses to each of your projects.

- Create a budget for your project and set up spending rules:

- Allowing Equipment and Materials and hardware for $5,000 per week

- Restaurants for $15 per transaction – your team will need to add their virtual card to their Apple Pay or Google Pay wallet to be used at restaurants

- Require receipts and memos

- Add your team working on this project: a supervisor to spend in the field and an admin to order material online.

Creating an employee travel policy

If your sales team or executives are traveling on a regular basis and you want to allow them to spend during their trips, enable this policy to easily allocate a travel allowance.

- Set up spending rules for your budget:

- Airlines: $1,000 per month

- Restaurant, groceries: $60 per day

- Hotels: $300 per day

- Your can also require them to add memos and receipts

- Add your employees when they’re traveling and then remove them from the policy

Ready to take controls of your employee and business expenses?

Coast customers can immediately leverage Budgets through their portal at no additional cost.

Willing to streamline your fuel and business payments? Apply to Coast today to empower your business with streamlined expense delegation, automated compliance, and enhanced visibility.