As a business operating a fleet of vehicles, you already optimize your fuel and fleet spend. You might have set precise fuel spend policies, or you rely on a telematics vendor helping you identify poor driving behaviors leading to wasteful spending.

But have you considered streamlining your business payments in a similar way? Traditional payment methods like checks or ACH can make expense tracking and reconciliation a tedious and time-consuming process, and don’t provide the required visibility and controls your business needs.

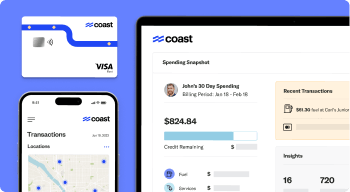

That’s where Coast virtual cards come in.

What Are Virtual Cards?

Coast virtual cards are similar to physical cards, but they are securely stored online, in your Coast portal. Similar to physical cards, they can be used anywhere Visa is accepted, for online purchases or in-store transactions. Each virtual card has its own unique card number, expiry date, and CVC.

What Sets Coast Virtual Cards Apart?

Coast virtual cards offer numerous advantages that make them the ideal solution for all your business expenses:

- Easy to use: With just one click, you can activate and pay using a Coast virtual card. It’s convenient for everyone in your office.

- Granular spend controls: Take control of your expenses with Coast’s precise controls. Set spend limits per merchant category and effortlessly add receipts on the go for maximum compliance.

- Enhanced security: Freeze your virtual card in seconds if your card security is compromised, protecting your funds and confidential information. You can also create temporary cards for one-time purchases, preventing unexpected charges.

- Complete view of expenses: Gain visibility and control over your expenses, including fuel, fleet, and other business purchases. Coast gives you a comprehensive view of your spending, making it easier to monitor and manage your cash flow.

- Fast payments with cashback on every purchase: Unlike checks or ACH, virtual card payments are instantaneous. Plus, with Coast, you earn cashback on every expense, helping you save even more.

Taking Advantage of Coast Virtual Cards for Your Fleet Business

Here are some ways you can leverage Coast virtual cards:

- One Card per Supplier: Simplify expense tracking by creating separate cards for each supplier. This approach provides precise control and visibility of expenses for different suppliers, such as one card for Google Ads and another for Facebook Ads.

- One Card per Expense Type: Keep your purchases organized by creating separate virtual cards for different expense types. This enables you to easily track and manage expenses for specific categories, like office supplies.

- Single-Use Cards for Extra Security: Create temporary virtual cards for secure one-time payments. Once the transaction is complete, simply cancel the card. This prevents overcharging and ensures your card details won’t work anymore.

- Virtual Cards for Recurring Expenses: Set up virtual cards for recurring expenses and forget about them. Your payments will be automatically debited, eliminating the need to check your calendar or worry about late payments. You can monitor these transactions in real time.

Setting Up Your Coast Virtual Card

Setting up your Coast virtual card is a breeze and requires minimal changes to your existing processes:

- Define your expense policy: Determine which expenses you want to assign virtual cards to. This will help you allocate budgets and control card usage effectively.

- Set your policies: Digitize your expense policies using Coast. Specify who can use a Coast virtual card, for what purposes, and set spending limits. This ensures compliance and reinforces your expense management framework.

- Create your card in one click: Creating your virtual card is quick and simple. Access your Coast portal and generate your card with just one click. No need to wait for it to arrive in the mail – it’s instantly available. Just copy and paste the card details from your Coast portal.

- Add your Coast card to your mobile wallet with Apple Pay: For added convenience, you can easily add your Coast virtual card to your mobile wallet using Apple Pay. Open your Wallet app, tap the “+” icon, and follow the prompts to enter your virtual card details. This allows you to conveniently access and use your Coast virtual card on the go.

Coast virtual cards are designed to streamline your business expenses, saving you valuable time and money. With enhanced security, granular spend controls, and a complete view of expenses, you can optimize your payment processes and stay in control. Get started with Coast virtual cards today and experience the benefits for your fleet business.