Coast lets you add multiple entities under a shared credit line, so every new acquisition gets its own account without repeating credit applications, paperwork, or lengthy underwriting, making onboarding seamless.

Private Equity

Modern expense management built for PE platforms

Enabling PE platforms to scale efficiently, without operational drag

and give operators the tools that make their day-to-day work easier.

Multi-entity control

Get unified visibility while keeping each operating company’s rules, controls, and reporting separate.

Standardized operations

Create uniform processes for fuel, corporate expenses, and spend governance so each business runs on the same efficient foundation.

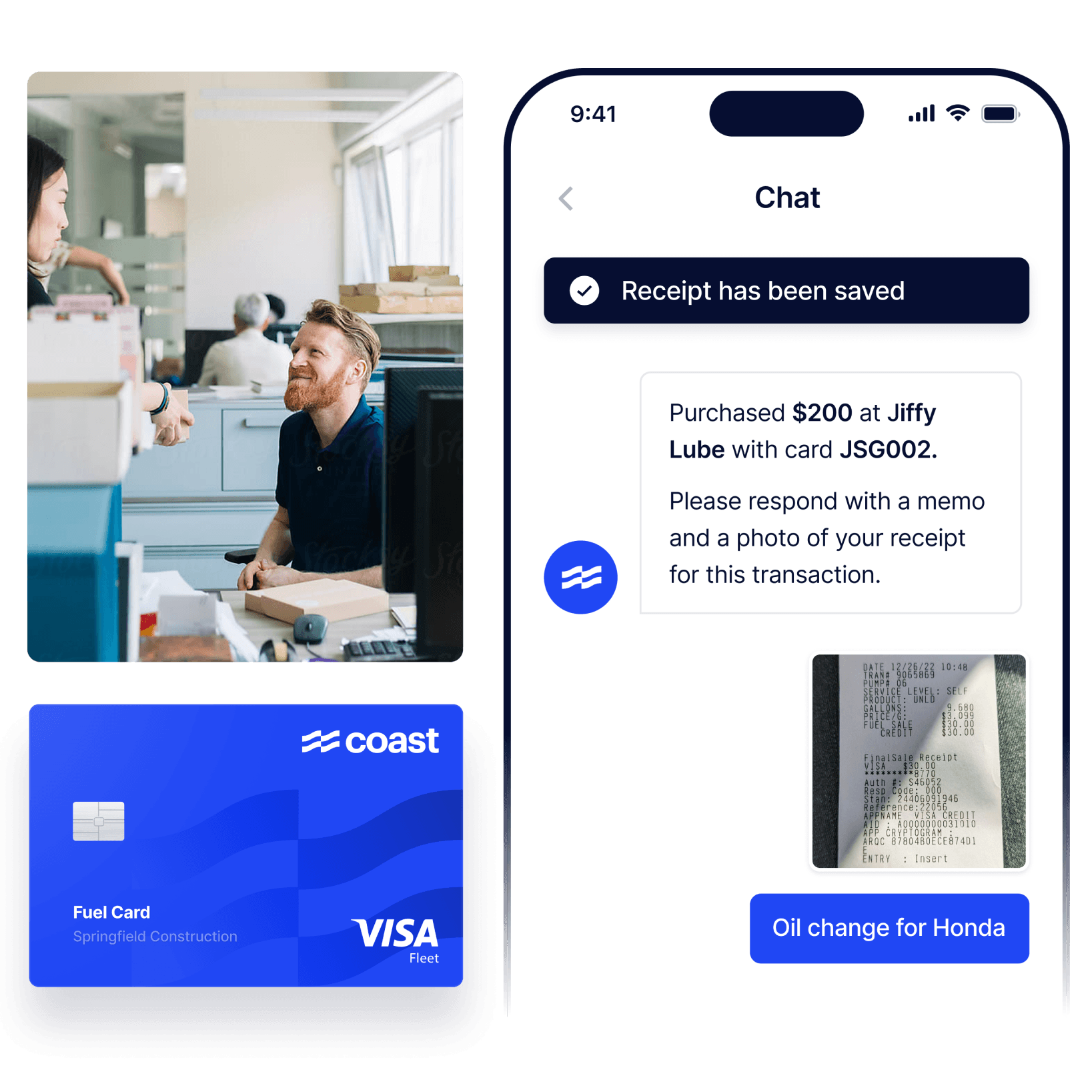

Easy card and account management

Issue, replace, and manage cards in seconds across multiple entities from one centralized platform.

Simple onboarding

Onboard new acquisitions with ease

Centralized reporting

Parent-level visibility. Entity-level control.

Get a consolidated view of fuel and corporate spend across every entity, with the ability to toggle between them from one dashboard and monitor activity in real time. Each business keeps its own reporting and custom spend rules, so the holding company gets governance and insight, while fleet operators keep the flexibility to run day-to-day.

Best-in-class integrations

Create operational efficiencies that drive savings

Improve the efficiency of every business you operate with integrated tools that prevent fraud, eliminate manual work, and unlock new savings. Coast’s telematics integrations, accounting automations, and nationwide rebate programs reduce operational drag and improve margins, without disrupting how your teams in the office or in the field work today.

Support and savings you can count on for every business

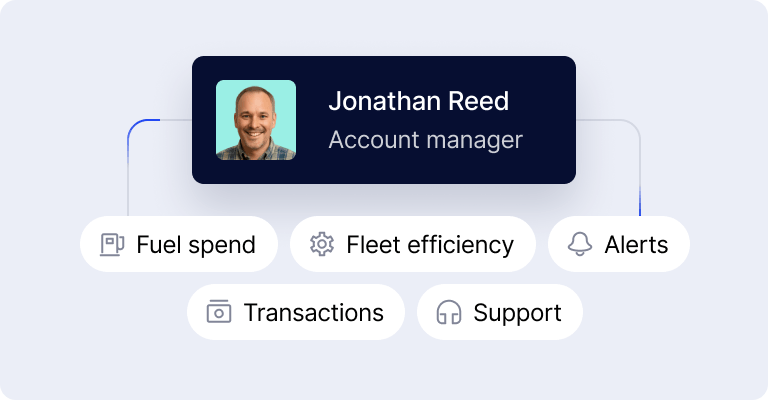

Dedicated account manager. Get white-glove support from day one from a dedicated account manager who understands the full needs of your business.

Responsive support. Our knowledgeable, 100% US-based team will solve your problem during the call, not after multiple call transfers.

Nationwide acceptance and rebates. With Visa acceptance and an extensive partner network, Coast supports your nationwide operations.

“Switch to Coast. The savings, the fraud controls, the support... it’s a no-brainer.”

Jason Walters

Vice President of Business Operations

Get up and running in a just few simple steps

Step 1

Get approved once

Once approved, every operating company can be added under the same shared credit line. No repeated applications or underwriting required.

Step 2

Distribute your credit line to new entities

Update the credit limits for any entities directly from the Coast portal. No need to wait for an account manager to make the change.

Step 3

Scale and onboard quickly

Issue cards, set controls, and start tracking spend within minutes, so your teams can hit the ground running.