If you’re looking to transition away from a small business credit card to something with increased spending power and enhanced expense management, a corporate card may be the solution.

In this article, we discuss the features to look for and tips for managing corporate cards better.

Table Of Contents

- Background On Corporate Cards

- Features To Look For In A Modern Corporate Card

- Tips For Managing A Corporate Card

Background On Corporate Cards

Corporate cards have been around for a long time and make it easier for executives, managers, and other employees to pay for authorized business expenses — like plane tickets, fuel, and hotel rooms — without having to use a personal credit card, check, or cash.

Recently, innovations in financial technology have unlocked many more features of corporate cards, and expense management by extension. Here are a few features to look for when choosing a corporate card with modern functionality.

Features To Look For In A Modern Corporate Card

1) Advanced Spending Controls

In contrast with legacy corporate cards, modern corporate cards typically offer some type of advanced spending controls to help the business manage its expenses.

These controls often allow you to:

- Limit purchases by days of the week

- Limit purchases by time of day

- Establish pre-set spending limits per transaction

- Set spending based on location

- Approve or deny transactions on a case-by-case basis

Such features can help your business control expenses and reduce spending across the board.

2) EMV Chip

A modern corporate credit card will often come with enhanced security to help prevent theft, abuse, and fraud.

An EMV (or Europay, MasterCard, and Visa) chip is a tiny microchip embedded in the card itself that generates a unique code every time your driver swipes to pay for fuel.

These codes are only valid once and cannot be used for any future transaction. That means if someone records your transaction and attempts to use the information to buy something else, the system will deny payment for that purchase.

3) Activation Code

In order to prevent theft and unauthorized use, some corporate cards come with another layer of security: pre-use card activation.

With this system in place, cardholders must first activate the card by sending a text from a specific linked cell phone number (i.e., their business or personal number).

If everything is correct, the system turns the card on. And when the employee swipes it to pay for a purchase, it authorizes the transaction.

On the other hand, if something is incorrect, the card stays inactive and, when the cardholder swipes it to make a purchase, the system refuses the transaction.

This unique feature makes it nearly impossible for an unauthorized person to make a purchase if the card is lost or stolen. Said unauthorized person won’t have the linked cell phone number and, therefore, won’t be able to activate the card.

4) An Open-Loop System

A good corporate card will give you and your team the ability and the flexibility to pay for purchases wherever necessary. This feature is called “open loop” and means that employees can use the card anywhere Visa (or other widely accepted card network) is accepted.

For example, if a salesperson needed to buy fuel for their fleet vehicle, a non-open loop card might restrict where they can fill up.

An open loop card, on the other hand, would allow them to fill up at the most convenient — or lowest-priced — station on their route.

5) Tracking And Reporting Tools

Another benefit of using a modern corporate card for business is the tracking and reporting tools that often come with them.

Keeping track of expenses with paper receipts can be a complicated and stressful task — especially if employees lose them or forget to turn them in after making a purchase.

In many cases, though, modern corporate cards give you the ability to go completely digital — i.e., do away with paper receipts altogether — and track everything online or in the cloud.

When researching card companies, look for one that provides this type of digital tracking and reporting so you can control spending, reduce waste and storage space, and make business expense management as easy as possible.

6) Automated Receipt Collection

We mentioned this earlier, but it’s worth discussing in a bit more detail because it, along with receipt matching, is among the more useful features that modern corporate card suites have to offer.

With legacy corporate cards, you would have to rely on your employees to turn in their receipts after making purchases. But with modern cards, a digital receipt is delivered directly to your computer for accurate recordkeeping.

7) Automated Receipt Matching

With automated receipt matching, you may be able to set the software so that it attaches a PDF copy of the digital receipts to any statements you receive and to then reconcile the data with those documents and your accounting software.

Such a feature can save you hours of paperwork and help you gain even more control over your corporate spending.

8) Virtual Cards

A virtual card is no different from a regular card – it comes with a name, number, billing address, CVV, and expiration date – but there is no physical copy to speak of.

Instead of issuing a physical card for face-to-face purchases, management can set up a virtual card for a variety of online and physical purchasing situations, including:

- One-off purchases

- Purchases from a specific company

- Purchases for a set dollar amount

- Recurring payments

A virtual card can give your business even more flexibility and provides more control over employee spending.

Tips For Managing A Corporate Card

1) Pay Attention To The Fees Involved

When shopping for a corporate card, make note of the fees that come with it and do your best to avoid the following:

- Transaction fees

- Credit-risk fees

- Out-of-network fees

- Per-gallon service charges (when the card is used to purchase fuel)

- Electronic payment processing fees

- Check processing fees

- Phone-payment fees

- Higher late fees for balances above a certain level

- High credit risk fees

Choose a card that makes your monthly statement easy to understand and never charges extra fees for purchases your employees need to make on a regular basis.

2) Find Payment Terms That Fit Your Business

Another important tip for managing a card is to find flexible payment terms that fit the way your business operates.

Look for terms that optimize company cash flow so that paying the statement doesn’t conflict with, or take away from, other essential company needs. And try to avoid a credit card that locks you into a less-than-ideal billing schedule.

For example, one card may lock you into a 14-day payment schedule so that your business has to make a payment every two weeks. Yet another credit card may lock you into a 7-day payment schedule so that your business has to make a payment every single week.

Operating without flexible payment terms puts your company in a difficult spot right from the get-go and makes it harder for your business to succeed.

3) Vet The Customer Service Before Signing Up

When shopping for a corporate card for your business, you’ll likely focus on the features mentioned earlier in this list — open-loop acceptance, advanced spending controls, security, and data tracking.

While all of those are extremely important, don’t overlook another feature that can provide more long-term value. That feature is customer service.

Just like a partner you bring into your business, the credit card company you choose can make your job easier or make your job more difficult.

If the credit card company offers customer service that doesn’t gel with the way your business works, they’re making your job more difficult.

Instead, make your job easier by choosing a customer service team that:

- Allows you to connect with them on your terms, not the other way around

- Understands your business and what it takes to succeed

- Delivers personalized service any and every time

- Responds quickly when you ask a question

- Gives you answers when you need them

- Provides easy ways to get in touch (e.g., text, email, and phone)

- Doesn’t transfer you through an endless phone tree to get to the right person

- Does everything they can to reduce or remove roadblocks that can hinder the way your business works

When you include the customer service team on the list of important features to research, you set your business up to partner with a company that has your best interests in mind and that can help you succeed.

Manage Your Corporate Fuel Purchases With Coast

Need a better way to manage your corporate fuel purchases? Coast can help.

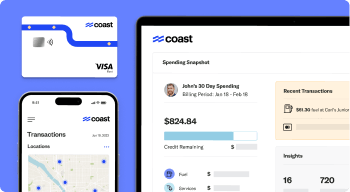

Coast provides real-time expense tracking and a powerful online management platform that puts all your business’s spending activities in the palm of your hand and provides full visibility of every dollar spent.

With Coast, your business will enjoy:

- Easy manager access

- Advanced spending controls

- Open loop acceptance

- Security alerts

- Data tracking and reporting

- And much more

For more information, and to learn about everything Coast can do for your business, visit CoastPay.com today.