Running a business of any kind is all about controlling costs. In fact, expense management permeates everything you and your team do on a daily basis. If you don’t keep tight reins on your budget, spending can run out of control and start your company down a bad path.

In this article, we discuss the most important aspect of expense management so you can keep your money where it will do the most good. The information here is most relevant for businesses with fleets but can be adapted for any business.

Table Of Contents

- Expense Management: Fixed Costs

- Expense Management: Variable Costs

- Expense Management: Cost Analysis

Expense Management: Fixed Costs

Every discussion of expense management starts with fixed costs.

Also referred to as overhead costs, they’re the payments you make that hold steady over the short term whether your vehicles are on the road one day a week or seven days a week.

Although you don’t have to worry about fixed costs fluctuating from month to month, they’re likely some of your biggest expenditures, and they’re often locked in for relatively long periods of time. Any decisions made in this category should only come after thorough analysis.

1) Office Space

One of the largest expenses that any business will pay — be it fleet-based or otherwise — is rent or mortgage for office space.

Office space is included with the fixed costs because, once purchased, the amount you pay every month is predictable. As such, you can plan and budget so you have enough funds when the bill comes due.

That’s not to say the payments you make won’t increase at some point, but you typically know the changes are coming — because they’re outlined in your contract — so you can plan and budget to make sure you have enough funds when it’s time to pay your bill.

Other office space costs include:

- Property taxes

- Office supplies

- Office equipment

- Utility bills (e.g., water, phone, internet, electricity, etc.)

These costs may fluctuate slightly from month to month as well (based on usage, weather, and other variables), but, again, they hold pretty steady in the short term.

2) Vehicle Payments

After office space, vehicle payments are the next largest expense that fleet managers have to deal with.

It doesn’t matter if you run vans, work trucks, semis, construction vehicles, or something else entirely, this mandatory expense often accounts for 10-20% of the fleet’s total operating costs.

If not managed properly, vehicle payments can quickly deplete your bottom line and make things extremely difficult for your fleet.

Managing vehicle payment expenses starts with determining what type of vehicle you need and how big your fleet should be.

You want vehicles that efficiently meet your needs, and you don’t want vehicles sitting idle because you have a bigger fleet than your business actually requires. Remember you can always expand your fleet later if you need to, but it’s often better to stay lean.

Once you’ve figured out what your ideal fleet looks like, the next important decision you’ll have to make about vehicle payments is whether to buy or lease your vehicles.

Buying gives you total control over how your vehicles are used and maintained but can be more expensive, especially for companies starting a fleet from scratch.

Leasing can help you save money, especially if you’re building a company fleet for the first time but will lock you into certain terms and conditions.

For example, a one-year lease with the option of extending on a month-to-month basis typically won’t include repair and maintenance costs.

Longer leases (say, three years) sometimes include repair and maintenance costs in the premiums, but they might also come with mileage restrictions.

If you want more information to help you decide if fleet leasing is right for your business, read our article: What Is Fleet Leasing And How Does It Work?

3) Insurance

The Federal Motor Carrier Safety Administration (FMCSA) requires that all fleet-based businesses have insurance on their vehicles before they can take the road.

In some cases, you can choose to pay that insurance annually or once a month. Either way, the bill is a fixed amount that doesn’t change from one billing cycle to the next.

And before you think, “Oh, I can get by without insurance.” No, you can’t. Insurance protects your business, the vehicle, the driver, and the motorists and pedestrians that navigate the same roads.

Without it, you can be vulnerable to fines, payments, and legal fees that can bankrupt your business and close it down for good.

Several major factors go into determining how much your business will pay to ensure your company vehicles:

Type Of Vehicle

Generally, trucks can be among the most expensive vehicles to ensure, with SUVs and vans costing less and cars being the cheapest. The age and condition of the vehicles are also taken into account.

Vehicle Use

The intended use of your vehicle fleet also affects your insurance costs. A company that uses its vehicles for house calls, such as HVAC repair, will usually pay less than a company using its fleet for shipping and transport. The more miles your fleet drives, the higher your rates.

Driver Experience

Driver experience can also play a role in determining how much you pay to keep your fleet insured. Hiring drivers with more experience can help you get lower rates.

To get the best rates on insurance, make sure you shop around and get quotes from several different companies.

Another way to spend less on insurance is to analyze your fleet claims history to identify patterns your insurance provider can use to craft a better policy. This can lead to significant savings on premiums.

Implementing strong safety measures and using dash cams and vehicle tracking tools can also potentially reduce the premiums you pay.

4) Depreciation

For large assets, like fleet vehicles, a big part of dealing with expense management involves calculating depreciation.

A certain percentage of the vehicle’s value will automatically decrease every year it’s in service. That will affect your taxes and the amount you have to pay or get back after filing with the IRS.

Because it’s a fixed cost, you can calculate (and plan for) depreciation with the following formula:

Depreciation = (Vehicle Purchase Price – Estimated Final Price) / Estimated Years Of Operation

Keep in mind that depreciation depends, in large part, on how carefully you maintain and operate the vehicle.

Good driving habits and effective preventative maintenance don’t just save you money by cutting fuel consumption and preventing breakdowns and accidents; they literally preserve value in your fleet vehicles by reducing depreciation.

5) Licenses And Permits

Licenses and permits are another fixed cost that all fleets have to contend with.

Examples of just a few of the items that fleets and their drivers need are:

- HAZMAT permits

- Over-length permits

- Oversize permits

- Overweight permits

- IFTA licenses

- Vehicle registration

- Commercial driver’s license (CDL)

From just this list, you can see that the fees attached to each document can quickly add up. Most are annual expenses, so you can plan and budget to have all the funds you need when it’s time to renew.

Expense Management: Variable Costs

When you consider variable costs, it’s easy to make the mistake of thinking that “variable” means “uncontrollable.” It’s true that many types of variable costs are out of your direct control. For example, you have no control over the price of gas.

However, the amount your company is paying in variable costs isn’t entirely determined by factors outside your control. It’s also determined by the amount of business you’re doing and by your practices and policies.

Some increases in variable costs are what we call good problems. If you’re making more deliveries because you’re getting more orders, your fleet will use more gas. You certainly wouldn’t choose to get fewer orders, would you?

On the other hand, some variable costs are higher than they need to be because of inefficiencies, and if some expenses inevitably rise because your business is growing, it becomes even more critical to optimize.

1) Fuel

It doesn’t matter what size or type of vehicles your fleet operates — they run on gas or diesel. Filling their tanks to keep them running costs money.

And, as prices continue to rise, fuel costs can approach 25% of a business’s operating budget. That makes fuel the highest variable cost a fleet will have to pay for.

Fleet managers must budget for fuel bills and take proactive steps to reduce fuel consumption unless they want this expense to spiral out of control.

There’s no magic bullet you can use to drastically cut your fuel expenses, but there are many small steps you can take which, when done consistently, may add up to a major savings.

One example is regularly checking your fleet vehicles for proper tire inflation. Under-inflated tires can impact your vehicles’ fuel mileage by as much as 3%, which works out to several dollars worth of gas wasted for a 40-gallon tank.

Keep your vehicles clean and well-maintained. This is especially important if your company operates in an area where it snows. Ice and snow clinging to a vehicle can weigh 100 pounds or more.

Planning efficient routes to your destinations will reduce the amount of fuel your vehicles use on each trip. Good driving habits like accelerating slowly, using cruise control, and reducing idle time also improve fuel efficiency.

Many people don’t know that fuel prices commonly follow a pattern over the course of the week. If possible, fill up your fleet earlier in the week when prices are lower, right after the weekend rush.

Using a fleet fuel card is one of the best ways to optimize your fuel expenses. The best cards will give you discounts or rebates on every gallon of gas you buy and also offer convenient reporting that makes it easier to track how much you’re spending on filling up your fleet.

Do careful research before picking a fleet fuel card, though. Many are accepted only at certain retailers or have time limits or rewards caps.

2) Tolls

Depending on the vehicles you put in the field and where your home base is located, your fleet may have to pay tolls to travel on certain roads.

Fleet managers can control this variable cost by:

- Actively avoiding corridors that levy fees on those who drive there

- Placing special emphasis on finding similar routes on non-pay roads

- Budgeting for tolls even though the total may vary from month to month

Of course, while it may be irritating to feel you’re getting nickel-and-dimed by tolls, you have to keep things in proportion. Planning routes to avoid tolls only makes sense if it actually saves you money. If alternate routes eat up more time and gas, then there’s no benefit for your business.

3) Maintenance And Repair

No matter how well your drivers treat your fleet vehicles, those vehicles will eventually need maintenance and repairs.

By taking a proactive approach to the matter and inspecting the vehicle on a regular basis, you can keep the maintenance side of the equation as low as possible.

Preventative maintenance can be thought of as the strategy of consistently spending smaller amounts to keep your vehicles in good running order so that you avoid unpredictable and potentially much larger expenditures on breakdowns.

You should develop a full preventative maintenance plan for every vehicle in your fleet. Although some maintenance tasks will apply to virtually any vehicle — like checking the oil and tire inflation, for example — many specifics will vary.

Start with the manufacturer’s documented service recommendations. Take into account the type of vehicle, its age and mileage, and its typical usage.

For each vehicle your company operates, you should have checklists for preventative maintenance tasks and checks performed on a daily, monthly, quarterly, biannual, and annual basis.

But even the best schedule can’t prevent breakdowns from occurring once the vehicle reaches a certain age or mileage. That’s why maintenance and repairs are included with the other variable costs — because they can change from week to week and month to month.

4) Unexpected Expenses

In every fleet, unexpected expenses will happen. These unpredictable costs usually take the form of:

- Accidents

- Tickets

- Fines

With a comprehensive safety-training program and in-vehicle telematics, you can usually reduce the frequency of these events to the point that they don’t impact your bottom line on too regular a basis.

There’s no way to completely eliminate the possibility of your fleet vehicles being involved in accidents. After all, they aren’t the only vehicles on the road. One of your fleet drivers could be stopped at a traffic light and still be hit by a distracted driver.

Hiring good drivers, being thorough about training them to operate safely and legally, and enforcing driver performance standards will go a long way toward minimizing your vulnerability to this type of unexpected expense.

One way to make sure that your drivers are adhering to your safety standards is with fleet telematics. Telematics tools can give you real-time information on your vehicles’ location, speed, fuel consumption, and more.

Proper preventative maintenance practices will also reduce the possibility of accidents caused by mechanical failures.

5) Driver Salary

With driver salary, we straddle the line between variable costs and what is considered semi-variable costs. It all depends on how you pay your drivers and how often that pay changes.

For example, if you pay your drivers a salary, that would be more of a fixed cost because the check you write when payday rolls around seldom changes.

If, on the other hand, you pay your drivers on a per-mile basis, that would be more of a variable cost because the check you write when payday rolls around is based on the number of miles they drove.

Be cautious in trying to cut expenses in this area. You’re putting valuable company assets in the hands of your drivers, and their behaviors have a big impact on how much you pay in other areas like fuel, maintenance, and insurance. Paying good drivers well to retain them is worth it.

Expense Management: Cost Analysis

No fleet expense management efforts would be complete without the cost analysis that comes from running total cost of ownership and vehicle cost per mile calculations.

Total Cost Of Ownership

For fleet vehicles, total cost of ownership can be calculated with the following formula:

Total Cost Of Ownership = Fixed Vehicle Costs + Variable Vehicle Costs

As an example, let’s say that you add up all your fixed vehicle costs (e.g., payments, insurance, licenses, and permits) for one of your newer work vans. You come up with a total monthly expenditure of $3,000.

Next, you add up all your variable vehicle costs (e.g., fuel, tolls, and maintenance) for a total monthly expenditure of $7,000.

Plug those numbers into the equation and you get:

Total Cost Of Ownership = $3,000 + $7,000

Total Cost Of Ownership = $10,000

When calculating total cost of ownership, it’s essential to keep track of the time period you’re examining.

In the above example, we calculated the total cost of ownership for one month.

You can customize the equation to show you your expenses for any amount of time you choose (e.g., three months, four months, six months, 12 months) by adding together the fixed and variable vehicle costs for those months.

Vehicle Cost Per Mile

Once you have the total cost of ownership, you can calculate the vehicle cost per mile with the following formula:

Vehicle Cost Per Mile = Total Cost Of Ownership / Total Miles Driven

Continuing with the example from the previous section, you examine your records to discover that one of your vehicles drove a total of 15,000 miles last month.

Plug that number into the equation along with the total cost of ownership, and you get:

Vehicle Cost Per Mile = $10,000 / 15,000 miles

Vehicle Cost Per Mile = $0.67 per mile

Armed with this data, you can find better ways to improve expense management in your fleet for variables such as:

- Building preventative maintenance schedules

- Analyzing driver performance

- Choosing whether to buy, rent, or lease your vehicles

- Deciding when (and how) to replace a vehicle

- Determining how many commercial vehicles to operate

Choosing Expense Management Solutions

When it comes to managing variable costs, businesses really fall into just two categories: ones that have fleet expenses, and ones that don’t.

Operating a fleet of company vehicles is such a significant source of both cost and complexity that businesses with fleets and those without may as well exist in two different worlds.

That’s why it’s critical to make sure the tool you’re considering is designed to handle a fleet vehicle use case when you’re considering solutions for tracking and managing your business expenses.

For business owners and fleet managers, tracking fleet expenses and maintaining documentation for compliance and maintenance can account for a significant portion of your administrative burdens. And we all know that time is money.

Trying to adapt a solution that wasn’t designed for the complexities of managing fleet-related expenses will get in the way of efficiency-increasing insights and eat up your valuable time.

In addition to offering discounts or rebates on purchases, some fleet fuel cards offer robust tools for fleet expense tracking. You can see all of your fuel expenses in a single report, with updates almost in real time.

For businesses with company vehicle fleets, using fleet fuel cards can lead to major savings not just through fuel discounts or rebates, but through saving time on administration.

Control Fuel Costs With Coast

When it comes to expense management, controlling fuel costs is one of the most important steps you can take — especially with the price of gas and diesel continuing to rise.

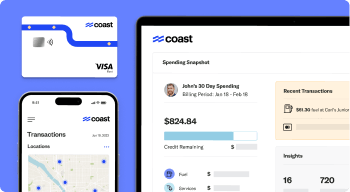

Coast is here to help. The Coast fleet fuel and fleet card can be used anywhere Visa is accepted, comes with advanced spending controls, and provides access to an online expense management platform that empowers you with real-time information related to your fleet.

For more information on how Coast can help you manage your fleet better and continue on the road to operational excellence, visit CoastPay.com today.