Effectively managing your fleet business’s bottom line can be difficult unless you understand exactly where your money is going. That’s why it’s so important to be clear on the different kinds of business expense categories.

If you’ve researched this topic before, you may have noticed that many articles on business expense categories are focused on tax deductions. This article isn’t intended as tax advice, but getting a better understanding of your business’s cash flow is always helpful, not just at tax time.

Some of those articles may also list so many different categories that it can seem overwhelming. This post will only focus on some of the most common expense categories and basic tips to help you get started managing your business’s spending.

Table Of Contents

- Why Knowing Expense Categories Is Important

- Employee-Related Business Expense Categories

- Equipment-Related Business Expense Categories

- Other Business Expense Categories

- Tips For Managing Business Expenses

Why Knowing Expense Categories Is Important

If you manage a fleet business, you know how expensive keeping your fleet running can be. It may even feel like unexpected costs continue creeping up on you at the worst possible times. That’s why knowing (and preparing for) all the different business expense categories is crucial.

Keeping up with specific expenses related to your business is vital. Incorporating streamlined accounting can help improve your bottom line, allow you to use your business funds where they’ll have the biggest impact, and may qualify your business for tax deductions.

With all of that in mind, here’s what you need to know about the different business expense categories your fleet-based business may encounter.

Employee-Related Business Expense Categories

Employee-related expenses include everything that your company spends on compensating, training, and generally taking care of the most important part of your business: the people who make it function.

Finding and keeping good employees is so vital to your business’s success. However, you should think very carefully about the human impact of any plans to cut expenses in this area.

Payroll

Payroll includes all types of direct monetary compensation your employees receive for carrying out their job duties. This includes gross income — whether paid hourly or as an annual salary — as well as any commissions for sales or bonuses for performance.

Employee Benefits

“Benefits” is a general term encompassing all of the types of compensation and perks your employees get which aren’t money going directly into their bank accounts.

Most commonly, the term is used to refer to company-provided group health, dental, and life insurance. Paid vacation and sick time, child care stipends, and options for helping your employees stay fit, like gym memberships, would also fall into this category.

Employee Education

Although employee education is sometimes counted under the broader category of benefits, it’s worth considering separately because it serves a different purpose.

While benefits like medical insurance and vacation time keep your staff happy and healthy, employee education helps them develop their professional skills and do their jobs better.

Expenses related to attending conferences, taking courses, and obtaining professional certifications would all fall under the category of employee education.

Retirement Contributions

While it may not make sense for all businesses to offer employee retirement plans, they can be another important factor in attracting and retaining high-quality staff.

If your company offers a 401(k) or another type of retirement plan for employees, it can make sense to tally these expenses separately to get a deeper understanding of your staff-related expenditures.

Professional Association Membership Dues

If one or more of your employees belongs to a professional association or organization, you may need to cover the fees or dues for being a part of that organization.

For example, you may make it a part of your employment agreement that drivers join the Owner-Operator Independent Drivers Association (OOIDA) and you will pay their annual dues.

The cost of paying memberships is an employee-related business expense. The same goes for subscriptions to professional publications.

That said, any dues or subscriptions you do pay must be in a professional association or for a professional publication that is related to your business.

For example, employee memberships in social clubs and country clubs don’t fall into this business expense category.

Equipment-Related Business Expense Categories

The word “equipment” might make you think of tools or machinery. While some types of business will certainly spend significant amounts on such things, “equipment” here is just used as a convenient catch-all for the tangible items your company uses to carry out business.

Rent And Mortgage Payments

Your offices and facilities might not seem like equipment, but all of the other things your company uses to work won’t matter if you have no place to get work done.

Rent and mortgage expenses are likely to be one of the biggest expenditures for many companies. This is an area where your business can save serious cash by conducting a thorough “right-sizing” analysis.

Are you paying for the space your business actually needs or just a space that looks impressive? Room to grow is good, but paying too much for unused space that may or may not be needed years in the future isn’t good.

When shopping around for new office or facility space, carefully consider the length and terms of any lease you sign and closely monitor the commercial real estate market in your area to make sure you aren’t locking yourself into a bad deal.

Utilities

Traditionally, utilities meant essential services like electricity, running water, and natural gas (if your property uses gas for heating). Today, it’s safe to say that your business won’t be able to get by without telephone and internet service as well.

Although you might not have much choice in your provider for traditional utilities, it’s definitely worth seeing if you have options to save money on telecommunications.

If you own your facilities, it might also be worthwhile to research whether you can make renovations that will reduce your utility expenses in the long run, such as improved insulation and ductwork for better climate control.

Fleet Vehicle Expenses

It’s not just trucking companies that have to think about fleet vehicles as a significant company expense category. Many other types of businesses also rely on a fleet of company vehicles to do things like make deliveries and service calls.

Expenses to keep a company vehicle fleet operating include gas costs, loan or lease payments, insurance, and all types of maintenance. Tracking different types of vehicle-related expenses is an important job for a company fleet manager all by itself.

Running a cost-efficient fleet starts with picking the right vehicles for the job. Getting the most value out of your fleet requires proper maintenance, good routing and dispatching, controlling fuel expenditures, and tracking and analyzing data to see where your company can improve.

Office Supplies

Depending on your business, “office supplies” might mean shovels and rakes instead of staples and binders.

It could also include bigger purchases meant to last your company for years, like a copier or piece of industrial machinery, or relatively cheap items that get used up and have to be resupplied regularly, like pencils.

To control expenses in this category, thoroughly research and compare those big ticket expenditures, perform routine inventory checks, and consolidate orders for day-to-day use items.

Tools

Depending on the type of business you run, tools may be one of the largest business expenses you manage.

Each service technician will likely need their own set of tools, and acquiring and maintaining those tools can get expensive very quickly. In many cases, your business can claim those expenses on its taxes and get a deduction for providing supplies to its employees.

That said, before you claim anything on your taxes, be sure to consult with a tax professional. They will likely have the knowledge you need to figure out which of your expenses go into which categories.

Other Business Expense Categories

Besides what you spend on compensating, training, and caring for your employees and what you spend on all of the things your business needs to get work done, there are a host of other possible expenses that don’t fit neatly into either grouping.

Some of these expenses are things that your business may be legally required to pay, while others are for things your business needs help with that you just can’t handle effectively in-house.

Advertising And Marketing

Whatever type of business you’re in, it’s essential to do some kind of advertising and marketing. Promoting your business is especially critical for young companies that can’t rely on gaining new customers through referrals and word of mouth.

Advice on marketing is beyond the scope of this article, but understand there is no “one size fits all” marketing strategy, and you should make sure any marketing professional you consult can clearly explain how their proposed plan will reach the right target audience.

Don’t be persuaded to spend money on marketing tactics that are in Vogue but are unlikely to reach the customers your business needs. For example, advertisements on TikTok may not be effective if your business services industrial HVAC systems.

Business Insurance

Accidents happen. People make mistakes. Various types of insurance products protect your business from costly liability when things go wrong. Some types are required by law, whereas others may just be a wise idea.

Almost every state mandates that businesses have workers’ compensation insurance for non-owner employees. And if you use company-owned vehicles, then they must be insured just like your personal vehicle.

Professional and product liability insurance protects you if a customer sues you because they claim they suffered a loss because of a problem with a product or service you sold them. Commercial property insurance protects you from mishaps in your offices or other facilities.

For most types of insurance, there will be many different carriers you can choose from. As with any insurance policy, make sure you completely understand the nuances of the coverage offered rather than just picking the lowest rate.

Licenses And Permits

Depending on the type of business you’re in, you may be required by law to get certain licenses and permits to operate — either for the business as a whole or for individual employees.

There’s no way to save money on these legally-necessary expenses, but failing to fulfill license and permit requirements can be costly, both in fines and in the damage to your company’s reputation.

Professional Services

This somewhat nebulous-sounding category includes anything you spend on improving aspects of your business where you need to get outside help from professionals specializing in that area.

Advertising could fall under this umbrella, but because of its importance, it’s usually categorized separately. Other common examples would be expenses paid to accounting or legal firms.

As with advertising, this article isn’t the place to give advice on picking a business accountant or attorney, but you should always prioritize finding partners for these important needs that you have complete trust in over simply saving money.

Tips For Managing Vehicle Business Expenses

As we’ve touched on throughout this article, vehicles and their related hardware will make up one of the largest, and most costly, of the business expense categories on this list.

As such, it’s the perfect place to start when considering ways to cut and control costs in all corners of your business.

Here are some tips for managing expenses for a fleet-based business.

1) Field Smaller Vehicles

Many fleet managers focus on just getting the job done — and there’s nothing wrong with that at first. But, when it comes time to cut costs, those same managers often neglect to consider the size of the vehicles they have in service.

Do your technicians absolutely need the power and capacity of the full-size pickups they currently run? Or could they do the job just as well with a smaller pickup, SUV, or work van instead?

These smaller vehicles typically cost less to operate, get better mileage, use less fuel, and experience less wear and tear than larger vehicles.

If an SUV, work van, or even a car can carry the tools and supplies your employees need and fulfill the demands of the job, it may benefit your business to switch things up.

That said, don’t feel that you have to replace all your trucks with smaller vehicles right away.

Try introducing one or two smaller vehicles into the mix first. If you notice a marked reduction in costs — while still maintaining high availability and functionality — consider introducing even more of those same vehicles into your fleet.

2) Optimize Fleet Size

While using the right size vehicle for the job may help reduce expenses within your fleet-based business, maintaining an optimal number of vehicles may also provide cost-cutting benefits.

Do some of your vehicles get used more than others? Do some vehicles sit idle for long periods of time?

Conducting an analysis of your fleet activity may reveal that your business is operating with a surplus of vehicles.

Even if you only have one or two such vehicles sitting around, you still have to put fuel in their tanks, pay their registration and insurance, and keep them maintained and in good repair.

That costs money — money that’s only going out because those vehicles aren’t contributing to the earnings of your business.

Take the time to examine your fleet, analyze the costs associated with each vehicle (more on this later), and optimize your fleet size so that each and every vehicle is working as close to 100% as possible.

3) Keep Tight Control Over Fuel Expenses

Fuel is one of the largest day-to-day expenses that any fleet-based business is likely to face — especially as gas and diesel prices continue to rise.

Establish rules for your drivers, and do your best to keep tight controls over any fuel they purchase so you can lower your overall bills and put the money you save to better use.

Here are some simple ways you can reduce your overall fuel bill.

Use A Fuel Card With Built-In Controls

Many business fuel credit cards come with built-in controls that allow you to:

- Restrict purchases to fuel only

- Limit spending by day of the week

- Restrict spending by time of day

- Set caps on transaction amounts

- Add additional expense categories (such as parking or maintenance)

More advanced fleet cards even allow you to set expense limits based on the location of the vehicle or the size of the vehicle’s fuel tank.

These features can help you manage fuel expenses and avoid unnecessary spending whether your vehicles are across town or across the country.

Use The Right Grade Of Gas

While higher grades of fuel do offer some benefits in certain situations, if your vehicles don’t need those benefits, you’ll be paying extra when you don’t really have to.

For example, Diesel #1 performs better in cold temperatures than Diesel #2. But, Diesel #1 is usually more expensive than Diesel #2.

If your vehicles are operating in areas where temperatures are consistently above 30 degrees Fahrenheit, you can save money right off the bat by using Diesel #2 instead of Diesel #1 (because you don’t necessarily need the anti-gelling properties of Diesel #1).

The same concept applies to gas vehicles. You can typically skip the more expensive grades and save money at every fill-up by choosing the lowest-priced option that will work for your fleet vehicles (e.g., 87 octane for gas-powered vehicles).

Take Advantage Of Gas-Finder Apps

Gas-finder apps can help your drivers avoid paying more than necessary when it comes time to fill up. These apps can help them find the lowest-priced fuel along whatever route they’re taking by:

- Looking across state lines (if the vehicle is near one), where prices may be less

- Giving them information about stations off the highway where prices tend to be lower

It can also be beneficial to remind drivers to stop for fuel before the tank is empty so they’re not forced to stop at the nearest (and, perhaps, more expensive) station.

4) Analyze The Costs Associated With Each Vehicle

Earlier in this article, we discussed fielding smaller vehicles and optimizing fleet size so that your business isn’t overspending when it doesn’t need to be.

One of the best ways to know if you need to reduce the size or the number of vehicles in your fleet is by conducting a cost analysis, including metrics like Total Cost Of Ownership (TCO) and Vehicle Cost Per Mile (VCPM).

Conducting a cost analysis for each vehicle in your fleet can give you a more accurate picture of what it’s costing you to keep everything running smoothly.

Here’s how to calculate the two most-revealing variables.

Total Cost Of Ownership (TCO)

To calculate the Total Cost Of Ownership (TCO), you’ll need to assemble all the fixed costs and all the variable costs for each vehicle.

Fixed costs include expenses such as lease or loan payments, insurance, licenses, and permits. Variable costs include expenses such as tolls, fuel, and maintenance.

As you assemble this information, be sure it’s all from the same time period. This is important because if you use fixed costs for one month and variable costs for three months, it’s going to throw your calculations off and provide incorrect results.

Once you have your numbers, plug them into the following equation:

Total Cost Of Ownership = Fixed Vehicle Costs + Variable Vehicle Costs

For example, if your fixed costs for vehicle A in May were $2500 and your variable costs were $3750, the TCO for vehicle A in May was $6250 ($2500 + $3750).

Vehicle Cost Per Mile

Once you’ve calculated the Total Cost Of Ownership, you can move on to calculating the next variable in your cost analysis: Vehicle Cost Per Mile.

For this, you’ll need the total miles driven for the month in question. Then, use the following formula to find your numbers.

Vehicle Cost Per Mile = Total Cost Of Ownership / Total Miles Driven

For example, if vehicle A drove 12,000 miles in May, your formula would look like this:

Vehicle Cost Per Mile = Total Cost Of Ownership / Total Miles Driven

Vehicle Cost Per Mile = $6250 / 12,000

Vehicle Cost Per Mile = $0.52 per mile

You can use this information as a benchmark to identify ways to reduce spending in this and other business expense categories.

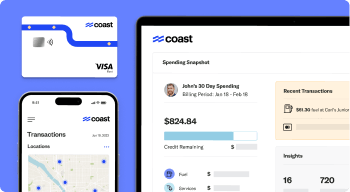

Manage Fleet Expenses Better With Coast

For businesses that operate company vehicle fleets, running and maintaining those vehicles can be one of your biggest business expense categories. But it’s also one of the areas with the most potential for savings.

The Coast fleet and fuel card helps fleet managers control expenses with rebates, robust spending controls, and detailed real-time reporting. It’s accepted at any gas station that accepts Visa and is suitable for fleets of any size with no spend minimums or caps.

To learn more, visit CoastPay.com today.