Businesses of all sizes and types can benefit from using a fuel credit card as part of their daily activities. How so?

These credit cards can make it easier for employees to pay for fuel and other expenses while on the road. They can even help you get control of spending and make everything run as smoothly and efficiently as possible.

But not all business fuel credit cards are created equal. How can you be sure you’re getting the features you need to manage — and grow — your company?

In this article, we discuss business fuel credit cards (also called fuel cards, fleet cards, or gas cards) in detail to help you choose the one that’s right for your team.

How To Choose A Business Fuel Credit Card

1) Investigate The Customer Service

When deciding on which fuel card to choose, most managers will focus on the more obvious features, such as security, payment terms, and fees.

That’s OK because those are certainly important for running your business well (we’ll even discuss them later on in this article). But, as you investigate all the fuel card options out there, don’t overlook their customer service.

In many ways, the customer service department of the card company you choose will function like a partner you bring into your business — they can either make things easier or more difficult.

If, for example, the customer service doesn’t match with the way you do business, they’re likely going to make things more difficult for you (even if they don’t intend to).

That’s not good for your business and highlights the importance of investigating each customer service department before committing to a specific fuel card.

Look for a customer service team that:

- Provides easy ways to get in touch (e.g., text, email, and phone)

- Gives you answers when you need them

- Understands the fleet business and what it takes to succeed

- Allows you to connect on your terms, not the other way around

- Delivers personalized service any and every time

- Doesn’t transfer you through an endless phone tree to get to the right person

- Responds quickly when you ask a question or have a problem

- Does everything they can to reduce or remove issues that can hold your business back

When you put customer service at the top of the list as you research fleet cards, you set yourself up to partner with a company that can help you succeed.

2) Prioritize Security

When you incorporate a fuel card into your business’s workflow, that card brings with it an inherent risk that a bad actor could gain access to your funds.

But, if you prioritize security, you can find an option that gives your drivers the freedom they need to do their job, while also providing a list of features that prevent overspending and unauthorized transactions.

Two of the most important features to look for are the EMV chip and the secondary security verification.

EMV Chip

The EMV chip (which stands for Europay, MasterCard, and Visa) is a tiny microprocessor embedded in the plastic itself that generates a unique code every time someone uses the card to make a purchase.

The unique code is only valid for that particular transaction and cannot be used again for any future transaction.

How does that keep your funds secure? If a bad actor records a transaction and attempts to use the information to buy something else, the system will deny payment for that purchase.

Secondary Security Verification

Chances are, you’ve been faced with a secondary security verification (SSV) when logging in to your email or some other online account (the system sends you a code you have to enter to prove that it is you).

Fuel credit cards with advanced security use a similar form of SSV, only it runs in the opposite direction.

For example, before making a purchase, the cardholder would have to send a text from a specific linked cell phone number (typically the cardholder’s) to activate the card.

A reverse SSV like this makes it nearly impossible for a bad actor to misuse a stolen card because they won’t have the means or the know-how to turn it on.

3) Choose An Open Loop Card

Another important feature to consider when choosing a fuel credit card is whether or not that card is part of an open loop network or a closed loop network.

A card that is part of a closed loop network can only be used at certain merchants (e.g., at gas stations associated with a particular oil company). Legacy fuel cards are typically closed loop and can only be used at locations that bear the name.

A card that is part of an open loop network, on the other hand, has no such restrictions and can be used pretty much anywhere that accepts Visa and Mastercard.

Not all cards offer this feature, so do your research before you sign up so that your drivers will be able to use the card wherever they need to while they’re on the road.

4) Look For Automated Receipt Collection And Matching

If you’re the sole carrier of your business’s fuel credit card, remembering to keep and then match those receipts to the monthly statement may not be all that difficult.

But add another driver into the mix, and your job will get exponentially more complicated. The driver may lose the receipt in transit, or they may forget to get one altogether.

And that’s only one driver. Imagine how much more complicated it would be if you had 10 drivers, 50 drivers, or even 100 drivers.

The right fleet gas card can help in this regard with automated receipt collection and matching.

When an employee makes a purchase, you receive a digital receipt so that even if the cardholder forgets to get a receipt or loses it on their journey, you’ll have a record of the transaction.

In many cases, you can then set the software that comes with these gas cards to attach a PDF copy of that digital receipt to your monthly statement and to automatically reconcile the numbers for future manipulation.

Automated receipt collection and matching can save your accounting and recordkeeping team hours of paperwork while at the same time helping you control spending and keeping your bottom line in check.

5) Decide If You Want The Ability To Create Virtual Cards

Modern fuel credit cards often come with the ability to create virtual cards for easier accessibility and payment.

When you create a virtual card, it comes with a name, number, billing address, CVV, and expiration date, just like a regular card. The main difference between the two is that, with a virtual card, there is no physical copy to speak of.

How do virtual cards work in a fleet-based business?

Instead of issuing a physical card for on-location, in-person purchases, you can set up a virtual card for a variety of online- or cloud-based-purchasing situations, including:

- One-off purchases

- Purchases from a specific company

- Purchases for a set dollar amount

- Recurring payments

While a virtual card may not be particularly useful at a business that requires the driver to present the card to make a purchase (e.g., a fuel stop or a service station), it can be incredibly useful if the business allows online payments.

In that case, the driver wouldn’t even have to carry a physical copy of the card — you could make the payments for them with a one-time virtual card.

That can give your business even more flexibility and control over employee spending.

6) Consider The Payment Terms You Need

As you investigate gas cards, be sure to examine the payment terms they offer and make sure those terms fit with the way your business operates.

In particular, look for terms that optimize your company’s cash flow so that paying the statement doesn’t conflict with, or detract from, other essential company needs.

Similarly, find a card that doesn’t lock you into a less-than-ideal billing schedule.

For example, one card may require that you make payments every 14 days, while another card may require that you make payments every seven days.

Such terms can put a serious damper on the funds your business has available for other necessary expenses, puts your company in a difficult spot right from the get-go, and makes it harder for your business to succeed.

Find The Right Fuel Credit Card For Your Fleet

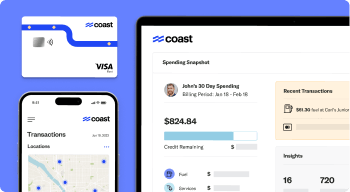

Finding the right fuel credit card for your fleet is worth the effort and time involved. Coast can help.

The Coast fleet and fuel card provides all of the features mentioned above (and more) and can put you in the right position to take your fleet management activities to a new level of simplicity, organization, and control.

To learn more about how Coast can have a positive impact on your bottom line and help your business run more smoothly and efficiently, visit CoastPay.com today.