You don’t need a large fleet to benefit from fuel cards for small business. Even businesses with only a few vehicles can manage operations better and gain control of their spending with solutions tailored for their business.

In this article, we discuss fuel cards and help you choose the best option for your operation.

Table of Contents

- What Are Fuel Cards For Small Business?

- How Fuel Cards Work

- Who Can Benefit From Fuel Cards?

- What To Look For In A Fuel Card For Your Small Business

- Bonus: Tips To Maximize MPG And Cut Costs

What Are Fuel Cards For Small Business?

What was once just a way for fleet drivers to pay for gas and diesel while on the road has evolved into an easy method for vehicle operators and fleet managers to:

- Pay for fuel

- Pay for maintenance

- Pay for emergency repairs

- Monitor charges wherever your drivers are

- Approve expenses in real time

- Control costs for individual vehicles or the entire fleet

- Avoid having to use cash, checks, or personal credit cards

- Add a layer of security to your spending

- Allow vehicle operators to charge other expenses if necessary

While some fuel cards for small business (a.k.a. fleet cards or fleet gas cards) can only be used at certain gas stations, others can be used practically anywhere.

For fleet operators, that increases the number of choices they have, makes them more efficient, and simplifies their trip.

How Fuel Cards Work

Fuel cards depend on two variables that serve as the foundation for all fleet activity: who can use the card and where the card is accepted.

Who Can Use The Card

When it comes to who can make purchases, most fleet fuel cards fall into two categories:

- Those who use a PIN to verify identity

- Those who use a text message to verify identity

In the first method, after you order cards for each vehicle, you add a driver to the account and assign them a unique personal identification number (PIN).

When the driver wants to fill up on fuel, they swipe the card (at the pump or at the register) and then enter their PIN to authorize the purchase.

In the second method, any driver can use any card (regardless of which vehicle the card came from) — no assigning cards to a particular driver or vehicle necessary.

When the driver wants to fill up on fuel, they first send a simple text message from a linked cell phone number to activate the card. Then, when they use the card to pay for fuel or other necessities, the system authorizes the purchase and the driver can proceed.

Where The Card Is Accepted

Just as there are different methods for verifying who can use the card, there are also different methods for determining where the card is accepted.

Cards generally fall into two categories — closed loop and open loop.

Closed loop fuel cards force drivers to constantly be on the lookout for and, perhaps, go out of their way to get to gas stations that accept the card they have with them. Many legacy fuel cards are closed loop cards.

That adds extra stress to an already stressful job and significantly reduces the driver’s freedom to make the best decision for them, the client, the route, and the business.

On the other hand, open loop fuel cards for small business give drivers the freedom to stop whenever and wherever they need to along the optimal route without having to go out of their way to get to an authorized station. Visa cards fall into this category.

Such real-world flexibility translates to a savings of both time and money over legacy fuel cards that restrict use based on any number of variables, including brand of fuel and location of fuel station.

Who Can Benefit From Fuel Cards?

Businesses of all sizes and types can benefit from using a fuel card — even if you only have a few vehicles right now.

And, while you may think that fuel cards are only for semis, other types of fleets can enjoy the perks as well.

Some fleets consist of scooters, motorcycles, UTVs, ATVs, cars, pickup trucks, forklifts, tractors, bulldozers, or backhoes. Any motorized vehicle can be considered a fleet (or at least the start of one). Even helicopters and airplanes fall into this category.

Whether you operate a single vehicle or many vehicles, your business can benefit from using a fleet gas card to pay for fuel, maintenance, repairs, and other expenses.

But not all fuel cards for small business are created equal. How can you choose the best fuel card for your team and your company? We’ll answer that question in the next section.

What To Look For In A Fuel Card For Your Small Business

There are a wide variety of fuel cards for small business these days. So, how do you choose the best one for your company?

Let’s take a look at the features that top-of-the-line fleet cards have to offer and how putting those features to use can help your business succeed.

1) Where It’s Accepted

One of the key features to look for in a fuel card for your small business is where it’s accepted.

As we mentioned earlier, some fleet card companies restrict where drivers can purchase fuel and obtain repairs. Other fuel cards allow drivers to get fuel when they need it, regardless of where they are along their route.

2) Policies And Controls

Advanced fuel cards for small business make it easy to set policies for each card and implement controls so that your drivers spend less on the road.

With some cards, you can restrict purchases to fuel only and limit spending by days of the week, time of day, or even transaction amount. You can also add additional categories, such as parking and maintenance.

In some cases, you can add even more controls based on the location of the vehicle and the size of the fuel tank. With such controls in place, you’ll avoid purchases outside an authorized area and non-business transactions hidden in the fuel bill.

We recommend looking for a fuel card provider that gives you access to an online portal that makes it easy to set policies and controls on all of your cards.

3) Tracking And Reporting Tools

Another key feature to look for in a fleet gas card is whether or not it will help reduce administrative paperwork.

Keeping track of vehicle expenses — typically in the form of paper receipts — is a complicated and stressful task all by itself. The stress only gets worse if drivers forget to turn in those expenses after their run. That’s when tracking becomes a real nightmare.

But with a fleet card for small business, you can do away with paper receipts altogether and track everything online.

Look for a company that provides digital records of every transaction so you can control spending, reduce waste and storage space, and make fleet management easier than ever before.

4) Low Administration Fees

When you use a fuel card with hidden fees, it can really cut into your bottom line. Avoid these unforeseen expenses by choosing a card with fair, transparent, and easy-to-understand terms.

No high credit risk fees. No higher late fees for high balances. No electronic, check processing, or phone-payment fees.

5) No Hidden Fees

Similarly, be sure to ask about hidden fees that might not be readily apparent in the fine print. Hidden fees to watch for include:

- Out-of-network fees (when you purchase fuel at an unapproved location)

- Per-gallon fees

- Transaction fees

6) Payment Terms

It’s important to evaluate the payment terms before choosing a fuel card for your small business. The terms of the card should optimize company cash flow so that paying the bill doesn’t fight against other fleet needs.

For example, some cards lock users into a 14-day payment schedule so the business has to make a payment every two weeks. Other cards go so far as to lock users into a 7-day payment schedule so the business has to make a payment every single week.

And those aren’t the only variables to be on the lookout for. Late fees, rebates, and rewards also come into play.

Late Fees

Payment terms often bury their late fees deep within the fine print. But these fees can add up quickly and take a big bite out of your bottom line.

For example, some fuel cards charge as much as 12.25% of the total balance when you miss a payment. A late fee such as this on a bill of $7500 means that you would owe an extra $918.75 ($7500 x 0.1225 = $918.75).

Be sure to investigate the late fees attached to your fuel card and do your best to avoid missing a payment.

Rebates

Fuel costs are the biggest expense that most fleets have to contend with. Wouldn’t it be nice if there was a way to reduce those numbers without cutting back on the fuel you buy?

Some top-tier fleet cards help reduce the total dollar amount your business spends on fuel by offering a per-gallon rebate wherever your drivers fill up.

When you multiply that rebate by the number of gallons your fleet uses every day, the savings really start to add up. However, it’s important to keep in mind that many fuel card providers set limits on the rebates they offer.

For example, one might offer a rebate for the first three months you use the card or for the first 100 gallons per statement period. Others may only offer rebates at certain gas brands.

It’s worth identifying the rebates your card offers and any limits attached so you’re not surprised down the road.

Rewards

Another helpful feature to look for in fuel cards for small businesses is the rewards you receive just for making regular purchases.

We’ve already talked about the rebates that some cards offer, but you may receive other rewards as well, including:

- Referral incentives

- Discounts with partner businesses

- Sign-up bonuses

7) Safety And Security

Security is important for today’s fleet operators and managers. The right fuel card adds a layer of safety for your business to put your mind at ease.

Choose a fuel card that lets you track everything so you can see where and when your vehicles are being used.

Look for a company that makes it easy to:

- Protect against unauthorized purchases

- Enable fuel-only purchases

- Assign cards to drivers, vehicles, or both

- Create custom policies and rules for different employees

- Limit purchases by time of day and day of the week

- Easily switch cards between drivers and vehicles

- Authorize one-off purchases

In some cases, you even get alerts about suspicious transactions and the ability to instantly lock or unlock a card in just a few clicks.

Top-tier fuel cards for small business even incorporate security into other aspects of the process in order to ensure that both the fleet card itself and the money it can access are safe.

The two most important are EMV chips and card activation.

EMV Chip

An EMV (or Europay, MasterCard, and Visa) chip is a tiny microchip embedded in the card itself that generates a unique code every time your driver swipes to pay for fuel.

These codes are only valid once and cannot be used for any future transaction. That means if someone records your transaction and attempts to use the information to buy something else, the system will deny payment for that purchase.

Card Activation

In order to prevent theft and unauthorized use, some fleet cards for small business add another layer of security: pre-use card activation.

With this system in place, drivers must first activate the card by sending a text from a specific linked cell phone number (i.e., their business or personal number).

If everything is correct, the system turns the card on and, when the driver swipes it to pay for fuel, authorizes the transaction.

On the other hand, if something is incorrect, the card stays inactive and, when the driver (or someone else) swipes it to pay for fuel, the system refuses the transaction.

This unique feature makes it nearly impossible for an unauthorized person to make a purchase if the card is lost or stolen. Said unauthorized person won’t have the linked cell phone number and, therefore, won’t be able to activate the card.

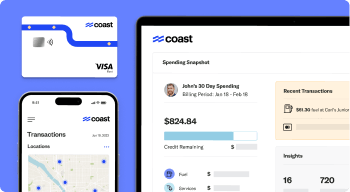

8) Expense Management Platform

Earlier in this article, we mentioned the online portal and how it can help you set policies and control spending.

And while it’s true that most fuel cards for small business offer some level of online access, only the most advanced have pushed that feature into the 21st century by creating a full-fledged expense management platform.

Such a platform gives you the same features as a regular online portal but also allows you to do much more.

For example, you’ll be able to:

- Restrict purchases to fuel only

- Limit spending by days of the week

- Limit spending by time of day

- Limit spending by transaction amount

- Add additional categories (such as parking and maintenance)

- Authorize purchases based on the location of the vehicle

- Restrict purchases based on the size of the fuel tank

With a full-fledged expense management platform at your disposal, you’ll also have full visibility of every purchase your fleet makes and access to exactly what’s happening with your vehicles and drivers, every second of the day (often in real time).

9) Good Customer Service

When shopping for fuel cards for small business, most fleet managers focus on the features mentioned earlier in this list — open loop network, spending controls, data tracking, fees, rebates, and rewards.

While all of those are extremely important, don’t overlook a specific feature that often provides more long-term value. Customer service.

Just like a partner you bring into your business, the fuel card company you choose can make your job easier or make your job more difficult.

If the fuel card company offers customer service that doesn’t gel with the way your business works, they’re making your job more difficult.

Instead, make your job easier by choosing a customer service team that:

- Allows you to connect with them on your terms, not the other way around

- Understands the fleet business and what it takes to succeed

- Delivers personalized service any and every time

- Responds quickly when you ask a question

- Gives you answers when you need them

- Provides easy ways to get in touch (e.g., text, email, and phone)

- Doesn’t transfer you through an endless phone tree to get to the right person

- Does everything they can to reduce or remove roadblocks that can hinder the way your business works

When you include the customer service team on the list of important features to research, you set your business up to partner with a fuel card company that has your best interests in mind and that can help you succeed.

Bonus: Tips To Maximize MPG And Cut Costs

1) Choose The Right Size Vehicle For The Job

Want to improve your fleet’s overall miles per gallon, cut costs, and reduce how much your fleet uses its fuel cards for small business?

One of the best things you can do is choose the right size vehicle for the job. There’s no reason to drive a one-ton work truck that gets 12-15 miles per gallon when a car that gets double that will do just fine.

If you have different size vehicles in your fleet, encourage your drivers to take the smallest one possible.

That may mean that they have to think about whether they’re going to haul a lot of cargo or pull a trailer, but the effort and time they put into such planning can save you hundreds, if not thousands, at the pump.

If you’re in the process of shopping for fleet vehicles, don’t just go with the most common option — choose the one that works best for your team and your business.

For example, if you’re considering the Ford Transit cargo van, ask yourself if, perhaps, your drivers could get the same utility out of a Ford Transit Connect cargo van.

The Transit is a full-size van and comes with an MPG closer to that of a pickup truck, while the Transit Connect is a smaller option that comes with an MPG closer to that of a minivan or SUV.

The simple act of selecting the right vehicle for the job — whether among existing fleet vehicles or ones you might lease — can significantly reduce what your business spends on fuel.

2) Monitor Tire Inflation

Proper tire inflation is an essential component of getting the most out of the tire itself, maintaining the life and safety of the vehicle, and reducing the number of times you have to use your fuel cards for business to pay for fuel.

One simple solution to this issue is to make sure that every vehicle comes with an air pressure gauge and that drivers check the tire inflation before starting out on a trip and every time they stop.

3) Keep Vehicles Clean

Keeping vehicles clean is a relatively easy way to squeeze a few more miles per gallon out of your fleet.

Over time, dirt, oil, grease, and grime build up on the body of a vehicle, add weight, and increase drag. This reduces the aerodynamics of the vehicle and causes fuel efficiency to drop. And, if your fleet operates in areas where it snows, the build-up is even worse.

Accumulated ice and snow on the top, sides, and undercarriage of a semi (for example) can add several hundred pounds or more to the total weight of the vehicle. Hauling more than necessary can reduce both the performance and the miles per gallon of your commercial vehicles.

You can avoid this by encouraging drivers to remove as much snow and ice as possible before driving during the winter months.

And make it a point to run your vehicles through the car or truck wash once or twice a month to maintain aerodynamic and fuel efficiency.

Take Your Business To The Next Level

Even if your fleet consists of only a few vehicles right now, Coast can help you track expenses, save time, and boost profits so you can add more assets and, perhaps, even expand to longer routes and into bigger markets.

With our online dashboard, you can manage spending, see purchase details, and control every aspect of the card’s activity. You can even quickly complete your accounting thanks to integrations with common software programs.

To learn more about Coast, visit CoastPay.com today.