Not all business fuel cards are created equal, and many fleet managers wonder how they can be sure they’re getting what they need to keep their operation on the road to success.

In this article, we discuss which features to look for — both from an operation and administration point of view — so that managers can choose the fuel cards for business that benefit everyone involved.

Table Of Contents

- Which Businesses Can Benefit From Using A Fuel Card?

- Features To Look For In Fuel Cards For Business

Which Businesses Can Benefit From Using A Fuel Card?

Fuel cards are no longer only beneficial for large businesses. Small to medium businesses can also benefit from using a fuel card. Additionally, modern fuel cards aren’t just for semis; other types of fleets can enjoy the benefits as well.

A small HVAC business with four or five work vans, a pizza delivery service with two or three scooters, or a limo company with a town car and a stretch option — all of them can benefit from managing gas and expenses with a fuel card.

Any motorized vehicle — car, truck, forklift, tractor, bulldozer, or backhoe — can be considered the start of a fleet as long as it’s used for business purposes.

With the right fuel card, business owners can gain real-time visibility into fleet-related transactions, control costs by setting spending rules that make sense for their business, and offer a flexible payment option for drivers while they’re on the road.

This includes industries such as:

- Plumbing

- Construction

- Pest control

- Roofing

- Solar

- Transportation

- Delivery

- Landscaping

But not all fuel cards for business are created equal. Some only come with a few features that are good for a handful of vehicles. Others offer everything a business needs to help them manage the growth of their fleet through all stages of development.

Below, we’ll discuss the features to consider when shopping for fuel cards.

Features To Look For In Fuel Cards For Business

1) Open Loop

One of the most important features to look for in fuel cards for business is whether or not they are part of an open-loop network or a closed-loop network.

A card that is part of a closed-loop network can only be used at certain locations, such as gas stations associated with a particular oil company (e.g., BP, Shell, Marathon).

Many legacy cards issued by those companies have closed-loop networks and can only be used to purchase fuel from stations that bear their name.

A card that is part of an open-loop network has no such restrictions and can be used anywhere that payment methods such as Visa and Mastercard are accepted.

When considering different fuel card options, owners should research and identify the ones that are open loop before signing up. Doing so will give drivers the ability to use the payment method wherever and whenever they need to while they’re on the road.

2) Fuel Discounts

Top-tier fuel cards for business will often offer a per-gallon rebate on all gas and diesel purchased using their card.

The rebate may only be one or two cents per gallon, but when that’s multiplied by the number of times drivers fill up and the number of gallons of fuel the fleet uses every day, the benefits can really start to add up.

3) Security

As bad actors continue to devise new methods to gain access to business accounts, security becomes one of the more important features to look for in fuel cards for business.

This is a problem for fuel cards, specifically, because they’re prone to skimming, PIN sharing, and lost or stolen card fraud. In fact, fuel card skimming is an increasingly prevalent concern for fleet companies.

In this scam, someone installs a device at a truck stop fuel pump that looks like a normal card reader. The device retrieves information from the driver’s fuel card. The thief then uses that information to make their own purchases.

Modern cards ensure that only authorized individuals can make purchases through the use of two security components: the EMV chip and the secondary security verification.

EMV Chip

The EMV chip (which stands for Europay, Mastercard, and Visa) is a tiny microprocessor embedded in the plastic itself that generates a unique code every time someone uses the card to make a purchase.

The unique code is only valid for a single transaction and cannot be used again for any future transaction.

So, if an unauthorized individual records a transaction and attempts to use the information to buy something else, the system will deny payment for that purchase.

Secondary Security Verification

Secondary security verification is common on many email and online accounts (it’s the code the system sends that users then have to enter into their device to prove that it’s actually them).

Top-tier fuel cards for business use a similar form of secondary security verification, only it runs in the opposite direction.

This type of reverse secondary security verification requires that, before making a purchase, the cardholder has to send a text from a specific linked cell phone number (typically the cardholder’s) in order to activate the card.

A reverse verification like this makes it nearly impossible for a thief to use a stolen card because they won’t have the means (both the card and the phone) nor the know-how to turn it on.

4) Card-Level Controls

Spending is not a one-size-fits-all activity, and fleet owners may need to authorize larger purchases for some drivers and smaller purchases for other drivers.

To help in this regard, some fuel cards for business come with individual card control.

This feature allows those in the office to control every aspect of spending for one card or all cards, and gives them the power to:

- Set expense limits based on the location of the vehicle

- Set expense limits based on the size of the vehicle’s fuel tank

- Limit spending by day of the week

- Set caps on transaction amounts

- Restrict purchases to fuel only

- Add additional expense categories (e.g., maintenance and parking)

- Restrict spending by time of day

All of this gives small business owners the control they need to reduce the costs associated with managing a fleet.

5) Assignment And Distribution

Some fuel cards for business allow managers to order as many cards as they need to outfit their fleet without having to print the driver’s name directly on the plastic.

Instead, managers can assign a certain card to a certain driver (or a certain fleet vehicle) via the software on their computer.

They can then hand out the cards when they make assignments or put the cards directly in the vehicle glove box for whichever driver uses the vehicle that day.

This simple assignment and distribution makes it easy to get cards where they need to be in a variety of situations (e.g., when a vehicle is retired or when drivers need to be reassigned).

6) Fee Structure

Some fuel cards for business will come with a long list of fees that can actually make using their services counterproductive.

Owners will need to read the fine print and be on the lookout for such fees and charges as:

- Transaction fees

- Credit-risk fees

- Out-of-network fees

- Per-gallon service charges

- Electronic payment processing charge

- Check processing charge

- Phone-payment charge

- Higher late charges for balances above a certain level

- High subscription and use charges

- Extended network pricing

- Setup charges

- Program maintenance charges

- Research charges

By choosing a card with a clear fee structure, fleet owners can avoid hidden fees and know what to expect each month.

7) Favorable Payment Terms

Fuel card payment terms can have a profound impact on a business’s bottom line. Owners should look for terms that fit the way their business runs and that optimize company cash flow without detracting from other essential needs.

For example, depending on workflow, managers may need a card that allows them to make payments every 30 days rather than every 14 (or even seven) days.

Frequent payment deadlines like these can put significant restrictions on the cash a company has available for other expenses, thus making it more difficult to succeed.

8) Responsive Customer Service

When investigating the various fuel cards for business, fleet owners should avoid restricting research to the main features (e.g., security, discounts, and fee structure).

Instead, they’ll want to dig deep into the company itself by testing out the customer service to see if the company:

- Understands the fleet business and what it takes to succeed

- Provides easy ways to get in touch (e.g., text, email, and phone)

- Allows managers to connect on their terms, not the other way around

- Gives answers when needed

- Responds quickly when managers ask a question or have a problem

- Delivers personalized service any and every time

- Does everything they can to reduce or remove issues that can hold back the business

- Doesn’t transfer callers through an endless phone tree to get to the right person

In many ways, the customer service department will function like a business partner and should make things easier for fleet owners and managers.

9) Automated Receipt Collection

The automated receipt collection feature of some modern fuel cards for business allows managers to set the system so that, when an employee makes a purchase, they receive a digital record of the transaction.

In some cases, managers can then set the software to match that digital receipt to the monthly statement and even reconcile the numbers automatically.

This feature alone can help save accounting teams hours of tedious paperwork.

10) No Hidden Fees

Regardless of the size of a fleet-based business, hidden fees can really cut into the bottom line and deprive the operation of the working capital it needs to get ahead.

Some fees that may be hidden in the fine print include:

- Per-gallon administration fees

- Higher late fees for high balances

- Electronic check processing charges

- Phone payment fees

- Credit risk fees

- Out-of-network fees

Similarly, fleet owners want to choose a card that makes the monthly statement as simple as possible and never charges extra fees for activities their drivers need to do every day.

11) Virtual Cards

This feature of modern fuel cards allows managers to set up a payment method for a variety of in-person, online, and cloud-based-purchasing situations without having to issue an actual physical card.

Virtual cards can be used to pay for:

- Purchases from a specific company

- Purchases for a set dollar amount

- One-off purchases

- Recurring payments

How can this benefit a small business with technicians and drivers in the field? Here’s an example.

A field service technician is scheduled to go across town for a service call and then return to the yard for another assignment. They fill up their van before they leave and it’s only a 30-minute trip across town, so you don’t issue them a fuel card.

However, upon arrival at the service call, the technician discovers they need a part they don’t have with them (and that the business doesn’t have in stock back at home base). The only option is to purchase the part new from a local vendor.

Instead of asking the driver to pay for the part with their own money, a fleet manager can call the local vendor and set up a virtual card for a one-time purchase.

The technician doesn’t have to present the physical card, but the purchase still goes through and the technician can get back to finishing the job successfully and on schedule.

This is just one basic example of how having the option to make payments with a virtual card can give small to medium businesses more flexibility with expense management.

12) Expense Management Platform

Most fuel cards used by businesses provide basic online access. But businesses need to be able to do more than just check their balance and pay bills.

Modern businesses need a full-fledged expense management platform with features that allow owners and managers to:

- Restrict purchases to fuel only

- Limit spending by days of the week

- Limit spending by time of day

- Limit spending by transaction amount

- Add additional categories (such as parking and maintenance)

- Authorize purchases based on the location of the vehicle

- Restrict purchases based on the size of the fuel tank

This type of access and control can give fleet managers the insight they need to keep track of drivers, vehicles, and expenses every second of the day (often in real time).

13) Tracking And Reporting

Modern fuel card platforms often include tools that help managers reduce paperwork and conduct tracking and reporting activities more efficiently.

We talked about how automated receipt collection can be a game changer for most businesses. The tracking and reporting features available with advanced fuel cards can help fleet owners and managers keep track of the numbers that power and move the business forward.

By combining those numbers with vehicle telematics data, maintenance logs, pre- and post-trip inspection reports, and other sources of information, managers will have a complete picture of the individual vehicles under their care and the fleet activities as a whole.

That type of knowledge can be invaluable for helping the business manage its assets wisely and maximize profits in the process.

14) Real-time Visibility

As we touched on in the Expense Management Platform section, real-time visibility is possible with the right fuel card.

With cloud-based connectivity, fleet managers and small business owners will be able to view purchases as they’re being made (i.e., as the transaction is being approved).

That means those with access (managers, owners, and other designated employees) can approve or deny purchases within seconds of the card being swiped.

This kind of real-time visibility can add another layer of security to the already substantial methods offered by most cards (i.e., EMV chips and secondary security verification).

It can also help owners control expenses and monitor driver activity while they’re on the road.

15) Customizable Spending Rules

Some advanced fuel cards give businesses more than just individual card control and allow managers to set spending rules for the entire fleet.

More than that, managers have the freedom to set these rules for all of the fuel cards they distribute, a subset of cards, a single card, or any combination they need to make the operation run smoothly.

This feature can help fleet managers and small business owners control expenses and reduce spending across the board.

16) Rebates And Rewards

Fuel costs are often the largest expense that small business owners have to contend with. A fleet and fuel card can help reduce those expenses by offering rebates and rewards.

Per-Gallon Rebates

The best fuel cards offer a per-gallon rebate wherever drivers fill up. Even with only one vehicle in service, over the course of a year, the money back can really start to add up.

For example, if a driver fills the 25-gallon tank on their pickup truck three times a week (a low number of fill-ups for some busy fleets) and the card used offers a $0.05 rebate per gallon, the business will get back $15 or more per month.

And while that may not seem like much at first, that’s almost $200 per year for just the one vehicle. If the business has five vehicles on the road, the savings could easily push into several thousand dollars.

That’s money that small business owners can put to use in other parts of their company.

Regular Purchase Rewards

Another helpful feature to look for in a fuel card is the rewards offered on regular purchases and other activities.

For example, some cards give rewards in the form of:

- Referral incentives

- Discounts with partner businesses

- Sign-up bonuses

These rewards (and others) can help businesses control, and even reduce, high fuel expenses without cutting back on the number of gallons purchased.

17) Integrations

No fuel card does absolutely everything a fleet needs for its day-to-day activities, nor does it operate separately from the other controls that small businesses use to keep things running smoothly.

For that reason, the integrations a card offers are crucial to a fleet’s overall success. The ability of the card to integrate with other business systems (both current and potential) can make a major difference in daily operations.

For example, if a fleet manager already uses a specific telematics, fleet management software, or accounting system, finding the right card to fit into that workflow is incredibly important. Ideally, the fuel card they choose will integrate with software like Quickbooks, Fleetio, Samsara, and Azuga.

18) Ease Of Use

Another important feature to consider when choosing a fuel card is its ease of use. If it’s overly difficult for drivers to make purchases, they may not buy into the process as completely as they should.

Top-tier fuel cards streamline the process with a single verification step — often a simple text message from a registered number — preceding payment.

For example, when a driver is ready to fuel up, he sends a quick text message to the fuel card company from a specific cell phone. Within seconds, the fuel card company activates the card so the driver can make approved purchases wherever he may be.

The Right Fuel Card For Small To Medium Businesses

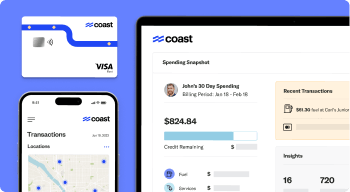

Choosing the right fuel cards for a business is worth all the time, effort, and research that goes into it. Coast can help make the process easier.

The Coast fleet and fuel card provides all of the features mentioned above (and more) and can put businesses in the right position to take their fleet management activities to a new level of simplicity, organization, and control.

To learn more about how Coast can have a positive impact on a business’s bottom line and help fleet-based businesses run more smoothly and efficiently, visit CoastPay.com today.