Small business expense tracking can get complex in a hurry. Many owners rush to keep track of business expenses on spreadsheets, only to discover that the endless tabs and rows leave them and their employees confused and overwhelmed.

The challenges are real—manual data entry in spreadsheets leads to errors, missing receipts cause tax-time panic, and unclear expense policies create frustration.

Fortunately, modern expense management software has evolved to address these pain points.

Whether you’re wondering if QuickBooks is good for tracking expenses or searching for more specialized solutions, there’s an option designed for your specific needs and budget.

Here’s our carefully researched breakdown of the best expense tracking tools for small businesses, categorized by use case and cost.

Best for Small Businesses with Fleets: Coast

For businesses managing vehicle fleets, tracking expenses goes beyond basic receipt management. Coast stands out in this category by combining comprehensive expense management with fleet-specific features that address the unique challenges of fleet operations.

Key features that make Coast great for fleet expense management include:

- Real-time visibility into fleet purchases with line-item detail

- Automated receipt and job code collection through a mobile app

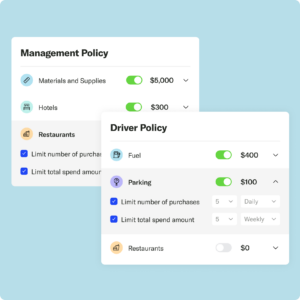

- Custom spending controls with merchant category restrictions

- Telematics integration for automated odometer capture

Direct QuickBooks Online sync for seamless reconciliation

What sets Coast apart is its ability to combine payment data with vehicle telematics, providing an extra layer of security against unauthorized purchases.

Fleet managers can monitor expenses—even non-operational ones like fleet insurance—across their entire fleet from a single dashboard, eliminating the need for multiple systems or manual paperwork.

Coast also streamlines bookkeeping by automatically enforcing expense policies and categorizing transactions. Employees benefit from a straightforward mobile process—they simply use their Coast card, snap a photo of the receipt, add the job code, and move on with their day—no expense reports or reimbursement delays.

Best for Direct Accounting Integration: Xero

If you’re looking for comprehensive accounting software with robust expense tracking capabilities, Xero offers an impressive balance of features and scalability. What sets it apart is its unlimited user access across all pricing tiers—a rare find in accounting software—and integration with over 1,000 third-party apps.

Key advantages include:

- Automated bill and receipt capture through Hubdoc

- Customizable dashboard for real-time financial insights

- Simple layout that makes reconciliation straightforward

- Strong mobile app for on-the-go expense management

- Basic inventory tracking included in all plans

Xero matches bank statements and transactions, streamlining usually time-consuming reconciliation for small business owners.

While the entry-level plan has some limitations on bills and invoices, Xero’s mid-tier and higher plans offer unlimited capabilities, making it an excellent choice for businesses that need comprehensive expense tracking integrated with their accounting system.

Most Sophisticated Features: Certify by Emburse

Certify by Emburse stands out for its blend of powerful capabilities and user-friendly design for those looking for powerful features in a small business setting. The platform excels at automating the tedious aspects of expense tracking while providing robust policy controls.

Key features include:

- Intuitive mobile app with advanced receipt scanning technology

- Support for multiple currencies and automated currency conversion

- Customizable expense policies and approval workflows

- Integration with major accounting software platforms

- 24/5 live technical support with comprehensive resources

Certify’s ReceiptParse technology accurately captures receipt data through your smartphone camera, making it valuable for small business employees to capture expenses. The platform automatically categorizes expenses and flags policy violations, saving hours of manual review.

For finance teams, Certify offers flexible reporting tools and customizable dashboards that provide real-time visibility into company spending. Employees benefit from a streamlined mobile experience—they can quickly capture receipts, create expense reports, and track approvals all from their phones.

Most Affordable: Freshbooks

If you’re looking for a cost-effective way to keep track of business expenses, Freshbooks offers an approachable solution that combines expense tracking with robust invoicing features. The platform stands out for its affordability and straightforward approach to expense management.

Key features include:

- Unlimited expense entries across all plans

- Built-in time tracking and mileage tracking

- Mobile app with automatic expense receipt scanning

- Customizable invoicing with expense rebilling options

- Extended phone support hours (8 AM to 7 PM ET)

What makes Freshbooks valuable for small business expense tracking is its simple, intuitive interface that doesn’t sacrifice essential features. The mobile app lets you capture receipts on the go, while automated bank imports help eliminate manual data entry—common pain points when tracking small business expenses.

While the entry-level plan has some limitations on billable clients and accounting features, Freshbooks’ mid-tier plans offer comprehensive expense management tools including bank reconciliation and double-entry accounting reports.

The platform is especially suited for small teams who need a straightforward way to track expenses without complex accounting feature overload.

Best for Travel Expense Management: Navan

Navan combines comprehensive travel booking with robust expense management features, making it a great choice for small businesses with high travel needs. It particularly simplifies the complex task of tracking business expenses across multiple countries and currencies.

Key features include:

- Global travel inventory with exclusive rates

- 24-48 hour reimbursement in 25 currencies across 45 countries

- Automated receipt scanning and expense categorization

- Custom spend policies with automated enforcement

- Integration with major ERP systems and HR platforms

Navan helps small businesses track expenses by offering both travel bookings and expense management in one platform. The mobile app lets employees easily submit expenses on the go, while finance teams benefit from automated policy enforcement and real-time spending insights.

For businesses managing travel expenses, Navan offers advantages like seamless corporate card integration, VAT reclaim abilities, and group travel management for up to 50 employees.

The platform’s AI assistant streamlines the booking process, while custom spend controls automate policy compliance.

4 Ways to Simplify Small Business Expense Tracking

While choosing the right expense management software is crucial, the best software cannot fix poor processes. Here are four proven ways to simplify expense tracking for your small business while maintaining accuracy and compliance.

Ditch the Spreadsheet

The allure of tracking business expenses in spreadsheets is understandable—they’re familiar, readily available, and seem cost-effective at first glance. However, as your business grows, this manual approach quickly becomes a liability rather than an asset.

Small business owners often find themselves buried in multiple versions of the same file, hunting down missing receipts, and spending hours reconciling data. These problems compound when multiple team members need to update and access expense information.

Most critically, spreadsheets offer limited visibility into real-time spending patterns. Without automated categorization and instant updates, businesses can’t make timely decisions about their expenses. This lack of immediate insight can lead to budget overruns and compliance issues that might have been prevented with better tracking tools.

Use Tools With Mobile Access

Gone are the days when expense tracking meant collecting paper receipts and logging them at the end of the month. Modern small business expense tracking, especially for fleets, demands flexibility and real-time capabilities.

Mobile-first solutions have become essential for businesses to streamline their expense management process. When employees can capture and submit expenses on the go, accuracy improves dramatically.

For instance, a quick photo of a receipt immediately after filling gas, real-time mileage tracking during client visits, or instant categorization of a taxi fare—these small actions add significant time savings and better record-keeping.

Mobile access also enforces policy and approvals. Managers can review and approve expenses from anywhere, eliminating bottlenecks in the reimbursement process. This speed and convenience also improve employee satisfaction by ensuring faster reimbursements.

Prioritize Security

Expense fraud isn’t just a concern—it’s a costly reality. Recent studies reveal alarming statistics about unauthorized spending, particularly in fleet operations.

According to our survey of fleet managers, 41% of fleets experienced fuel fraud weekly or monthly. Even more concerning, 62% of fleets experiencing fraud could not recover any of the lost funds.

These numbers highlight why modern expense management tools must go beyond basic tracking to include robust security features. For example, in fleet operations, solutions like Coast’s SMS check-in system requires drivers to verify their identity before fueling.

By tying employee phone numbers to specific cards and integrating them with telematics data, you can effectively eliminate unauthorized purchases and prevent expense fraud before it happens.

The principle applies beyond fleet management—whether you’re handling travel expenses, office supplies, or client entertainment, implementing security measures through your expense management software helps protect your bottom line.

Features like automated policy enforcement, real-time spending alerts, and multi-level approval workflows create a security framework that protects your business while maintaining operational efficiency.

Define Clear-Cut Policies

Creating well-defined expense policies might seem like a basic step in small business expense tracking. Unfortunately, many small businesses either overlook this or rely on complex guidelines that employees struggle to follow. The key is finding the right balance between control and flexibility.

Start by establishing clear categories for common expenses. Whether it’s mileage reimbursement rates, meal allowances, or travel booking guidelines, your policies should be specific enough to prevent confusion but flexible enough to accommodate real-world situations.

This means creating straightforward guidelines about what can be expensed, when, and by whom. Digital expense management tools can help by automatically flagging out-of-policy spending, sending reminder notifications for missing receipts, and providing clear approval workflows.

This automation not only ensures compliance but also eliminates awkward conversations about rejected expense reports.

Take Control of Your Small Business Expenses

The right expense management solution can transform a challenging aspect of business into a streamlined process. Coast offers a comprehensive platform that combines all the best practices we’ve discussed—automated tracking, mobile accessibility, robust security, and policy enforcement—in one intuitive solution for small businesses with fleets.

With Coast, you can say goodbye to end-of-month bookkeeping headaches. The platform helps you control team spending while eliminating hours of administrative work through automated policy enforcement and real-time expense monitoring.

Whether you’re reviewing transactions, reconciling expenses, or analyzing spending patterns, Coast’s dashboard puts your entire operation’s financial pulse at your fingertips.

Ready to modernize your expense tracking? Learn more about how Coast can streamline your business’ expense management and protect your bottom line.