The convenience of e-commerce has made it an essential tool for both personal purchases and business transactions. But digital payments can also present unique challenges to businesses around spending controls, expense tracking, and security. Virtual credit cards can help allay some of these challenges when used effectively.

Table Of Contents

- Why Are Virtual Credit Cards Gaining Popularity?

- What Is A Virtual Credit Card?

- How Virtual Credit Cards Work

- Who Offers Virtual Credit Cards?

- Benefits Of Virtual Credit Cards

- Limitations Of Virtual Credit Cards

Why Are Virtual Credit Cards Gaining Popularity?

Because businesses are now doing a majority of their purchasing online for necessary supplies and services, new complexities have been added to managing corporate credit card accounts.

For example, it’s convenient to use a company card to pay for the business’s subscription to a service or app, but storing credit card info can make it easy to overlook a sudden change in the subscription price.

As online credit card purchases proliferate, businesses have to pass around cards or issue cards to more employees. This can make it difficult to control spending.

If company credit card info is exposed in a data breach, the lost productivity of cleaning up the mess will be costly, even though the business will eventually get money from fraudulent purchases back.

Virtual credit cards offer businesses an effective solution to all of these concerns.

What Is A Virtual Credit Card?

In the traditional sense, a virtual credit card is a temporary, disposable credit card number used for making purchases online. A randomly generated account number, security code, and expiration date are used to process the payment, and the purchases appear on the business’s account statement as normal.

Now, however, this kind of card doesn’t have to be temporary, and it’s not only used for online purchases. A modern virtual credit card is stored on a mobile device and can be used to pay for purchases or services online or contactless in stores. It has a card number, expiration date, and security code.

How Virtual Credit Cards Work

For in-person purchases, most credit cards now come equipped with a security microchip. This chip generates a unique code for each purchase that can’t be used in the future and prevents thieves from saving card data and using it for fraudulent purchases.

A virtual credit card applies the same basic principle to online purchases by using unique payment information for each transaction.

This helps keep the company safe from fraud because if the merchant or service provider suffers a data breach, the thieves will only be able to access the “throwaway” information and not the business’s real card information.

Who Offers Virtual Credit Cards?

Some major credit card companies now offer the ability to create virtual credit cards as a benefit for their customers. So, if the business is interested in getting a virtual credit card, it’s worth seeing if an existing company credit card offers virtual cards as a feature for its customers.

That said, the value of virtual credit cards for businesses has led to a number of companies offering credit lines and introducing virtual credit card systems that allow companies to more effectively and safely manage expenses.

Benefits Of Virtual Credit Cards

Using a virtual card for online business purchases offers several advantages depending on the specific features of the card used. Let’s take a look at some of these benefits.

Security

As already discussed, security is the main appeal of using a virtual card. It obscures critical company payment information and compartmentalizes the damage done if an online retailer suffers a data breach.

Since a hacker will only gain access to the virtual card info used for the particular merchant they attacked, they’ll be unable to make fraudulent purchases elsewhere. And the business won’t have to spend time changing card details saved on many different sites if a card is compromised.

Virtual credit cards are worth trying for many users for the peace of mind they bring alone.

Control

Another possible benefit is setting controls on different types of spending. With virtual cards, managers may be able to set a per-transaction spending limit for each virtual card.

This feature allows the business to set up a virtual card with a spending limit to pay for a certain subscription service and be protected from “statement shock” if the monthly cost goes up unexpectedly.

It also allows employees to cover minor expenses, like parking fees, without worrying about larger, unauthorized purchases.

Expense Tracking

Reviewing and reconciling credit card purchases can be a major source of administrative work for many businesses. Virtual credit cards can help by greatly simplifying the process of managing expenses.

Creating virtual cards for specific purposes and setting rules for transaction amounts can effectively automate some of the data entry involved in tracking business expenses and prevent unexpected, over-budget spending.

For Online And In-Store Purchases

As we mentioned, because virtual credit cards are stored digitally, they can be used both in person and online. This makes them beneficial for most types of businesses and their buying needs.

Limitations Of Virtual Credit Cards

Although these cards can be very useful for anyone who wants to shop more securely, they serve specific purposes and aren’t useful in every situation.

Keep in mind that using a virtual credit card might present problems in situations where online purchases lead to in-person interactions with retailers.

For example, many hotels require the card used for a reservation to be shown at check-in. This presents an obvious problem if a virtual credit card was used to book the stay.

A similar difficulty can occur if the business buys something online and then needs to return it in person. The standard way of processing a refund at many retailers is to have the employee insert or swipe the card used for the purchase. If a virtual card was used, the business may have to settle for store credit.

How To Pick A Virtual Credit Card

Maybe by now the business is convinced that a virtual credit card is a solution to its online security worries or administrative hassles, and it wants to get one. Here are some factors to consider when picking which card best fits the business’s needs.

When shopping for a virtual credit card, management should keep in mind that virtual credit cards are most often a service that comes with a physical credit card or fuel card.

As such, researching the variables that apply to the physical card is just as important as researching the variables that apply to the virtual credit card.

We discuss both types of variables in the list below.

Number Of Cards Issued

Some virtual credit cards have a cap on how many unique virtual cards can be issued (e.g., a certain amount each month). For personal users, this is unlikely to be a serious problem, but it could become an inconvenience for businesses.

If management is considering a virtual credit card for the business, they should realistically assess how many the company will need to make sure they don’t run up against a limit.

Fees

Before getting a virtual credit card, management should thoroughly review any fees associated with its use, just like if the business were applying for a new traditional credit card.

Although security rather than savings may be the main appeal of a virtual credit card, businesses should keep an eye out for fees that will throw off the company’s bottom line just because of its virtual card features.

Spending Controls And Tracking

If all a business wants from a virtual credit card is the ability to protect personal information while purchasing online, in-depth options for configuring different virtual cards won’t really be of interest.

If the business wants to set up many different virtual cards for different types of spending or recurring charges, then it will need more robust controls.

When considering a virtual card, management should research the options available for setting limits on the amount and frequency of transactions. This will ensure virtual cards are actually helpful for managing cash flow and expense tracking.

Integrations

If management is hoping to use virtual credit cards to reduce administrative hassles for the business, they should consider how the card integrates with the processes and tools that the company already uses for managing budgets and tracking expenses.

For example, if a fleet manager already uses a specific telematics, FMS, or accounting system, finding the right physical and virtual credit card to fit into that workflow is incredibly important.

Ideally, the one they choose will integrate with software like QuickBooks, Fleetio, Samsara, and Azuga.

Acceptance

An important feature of any credit card — be it physical or virtual — is whether it’s part of an open-loop network or a closed-loop network.

With a closed-loop network, employees, drivers, and management can only use the card at certain approved locations.

For example, some fuel cards are only good at locations associated with a particular oil company, such as Marathon, BP, or Shell. Often, then, the virtual credit card feature would only work at those approved locations.

With an open-loop network, employees, drivers, and management can use the card anywhere payment methods such as Visa and Mastercard are accepted.

This gives everyone in a business the ability to use both a physical credit card and a virtual credit card wherever and whenever they need to, whether they’re in the office, working from home, or on the road.

Whether a business is only concerned with finding a fleet fuel card for its drivers or wants to include the option to issue a virtual credit card, choosing an open-loop option is one of the most important things to investigate before signing up.

Discounts

Some card companies that offer virtual credit cards also offer discounts on frequently purchased items.

For businesses with service vehicles on the road (e.g., HVAC, plumbing, landscaping), one of the best discounts to look for is a per-gallon markdown on all gas and diesel purchased using the card.

The discount may only be one or two cents per gallon, but when those pennies are multiplied by the number of times drivers fill up and the number of gallons of fuel the fleet uses every day, the benefits can really start to add up.

For example, if a driver has to fill up the 26-gallon tank on their Mercedes Sprinter 2500 three times a week, the business will receive $1.56 in savings. Multiply that by the total weeks in service per year (let’s say 48), and the business will save almost $75 annually.

Again, that may not seem like much at first, but if the business has five vehicles on the road, it will save close to $375 in fuel costs over the course of a year.

Security

As we talked about in the Benefits Of Virtual Credit Cards section, security is an extremely important part of any credit card — physical or virtual.

Businesses should look for two important features in the physical card they choose to host a virtual credit card: EMV chips and secondary security verification.

EMV Chips

EMV chips are tiny microprocessors embedded in the plastic of a physical credit card. The microprocessor generates a unique code every time it’s used to make a purchase. That code is only valid for a single transaction and cannot be used again for another transaction.

These unique, one-time codes prevent unauthorized individuals from recording a transaction and attempting to reuse the information to buy something else.

If they do attempt to conduct an unauthorized purchase, the credit card system will deny payment because the code has already been used once before.

Secondary Security Verification

A secondary security verification (or SSV) is a feature of top-tier credit and fleet fuel cards that requires authorized card users to enter another code to prove it’s actually them making the purchase. If a user fails to enter the SSV, the credit card will deny the transaction.

Most secondary security verifications run in one direction: from the credit card company to the card user.

When the card is swiped or the number is entered to initiate a purchase, the credit card company sends a unique code to a cell phone number or email address. The user must then enter that number to activate the card.

Some secondary security verifications run in the opposite direction: from the card user to the credit card company.

This type of reverse SSV requires that, before making a purchase, the card user must send a text message from a specific linked cell phone number (typically the cardholder’s) in order to activate the card.

A reverse SSV like this makes it nearly impossible for a thief to use a stolen card because they won’t have the means (both the card and the phone) nor the know-how to turn it on.

Customer Service

When choosing a credit card, fleet card, or fuel card, fleet owners and managers often focus on some of the main features mentioned earlier in this article (e.g., security, spending controls, and integrations) and forget one of the most important variables: customer service.

In many ways, the customer service department of the card company a business chooses will function like a partner — they can either make things easier or more difficult.

If, for example, customer service doesn’t match with the way the business operates, they’re likely going to make things more difficult (even if they don’t intend to).

That’s not good for business workflow and highlights the importance of having management investigate each customer service department before they commit to a specific credit card.

Those vetting prospective credit cards should look for a customer service team that:

- Provides easy ways to get in touch (e.g., text, email, and phone)

- Gives answers when needed (i.e., in a timely manner)

- Understands the fleet business and what it takes to succeed

- Allows businesses to connect on their own terms, not the other way around

- Delivers personalized service every time

- Doesn’t transfer the caller through an endless phone tree to get to the right person

- Responds quickly when a question is asked or a problem is presented

- Does everything they can to reduce or remove issues that may hold the business back

When a business puts good customer service at the top of its “must-have” list, it sets itself up to partner with a company that can help it succeed.

Automated Receipt Collection And Matching

If a business only has one or two physical credit cards, or only initiates one or two virtual credit cards per month, matching receipts to the monthly statement may not be that difficult.

But the more cards that a business carries and the more virtual credit cards it issues, the more complicated it becomes to collect and match receipts to reconcile card activity.

A good business credit card or fleet card comes with automated receipt collection and matching.

The feature allows managers to set the system so that every time a transaction is made, the business will receive a PDF copy of the digital receipt and it will be reconciled to the credit card statement.

Automated receipt collection and matching can save accounting and recordkeeping teams hours of paperwork while helping managers control spending and keep the business’s bottom line in check.

Rebates And Rewards

For many fleet-based businesses, fuel costs are often the largest expense on the books. But, with the right credit card, fleet card, or fuel card, businesses can gain access to rebates and rewards that can help offset the high cost of keeping the fleet running.

Rebates

We’ve talked about the discounts that some credit cards offer, but many of those same cards also offer per-gallon rebates whenever (and wherever) drivers fill up.

One of the many nice things about this is that those rebates also apply to purchases made using virtual credit cards.

For example, if a business sets up a virtual card to pay for the delivery of fuel to its onsite fuel tanks, the transaction may be subject to a per-gallon rebate that can help reduce the impact on the company’s bottom line.

Even if the rebate was $0.05 per gallon, filling up a 250-gallon tank means that the business would receive $12.50 back every time the fuel was delivered.

Rewards

Some physical and virtual credit cards also offer rewards on purchases that a business makes regularly.

For example, some cards give rewards in the form of:

- Referral incentives

- Discounts with partner businesses

- Sign-up bonuses

These rewards (and others) can help managers control and reduce spending on necessary and repeated purchases.

Payment Terms

Businesses shouldn’t neglect to investigate the payment terms of the physical and virtual credit cards on their list of possibilities because those terms can have a profound impact on the way the business runs and how it manages its cash flow.

For example, some cards mandate that payments be made as regularly as every seven days. Others are a bit less restrictive and extend the payment deadline to every 14 days.

But, does that really fit the way the business works best? Would the business be better served with 30-day payment terms?

Managers should look for a card that matches their cash flow and avoid too-frequent payment terms that can tie up available funds that would be better spent on other expenses.

The Bottom Line

Using digital payments offers significant advantages, but businesses must ensure that purchasing for business needs both online and in person doesn’t compromise budgets or security or add administrative overhead. More and more companies are turning to virtual credit cards as the solution.

Although virtual credit cards are often explained primarily as a tool for protecting against fraud, they also have other important benefits, like managing recurring expenses and preventing overspending. These benefits can be especially helpful for businesses.

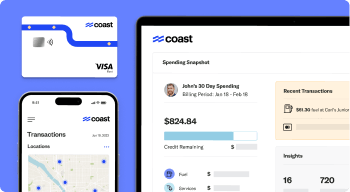

If the business is looking for other ways to control expenses and streamline administration, such as better managing fuel and maintenance expenses for company vehicles, check out CoastPay.com.